The Worst Housing Markets Have the Strongest Buyer Interest

This might seem surprising, until you think about how price changes affect consumer behavior

When you think of places where real estate is in high demand these days, places like Manhattan and Washington, D.C. probably come to mind. Certainly, the sunbelt regions decimated by the housing bubble won't be on the list. And yet, according to a new report by real estate listing website Trulia, the opposite is true.

Trulia's Findings

To create its new Metro Movers Report, the company created an index to measure the home buying demand in metro areas. It calculates the index by using its own copious data on property searches. Each area's index value is defined as the number of inbound property views by outsiders for every outbound property view by locals. Although this doesn't take into account home buying demand expressed by the area's own residents, it probably shouldn't -- this would translate mostly into churn. What matters more is the amount of demand from the outside compared to the area's current residents looking to leave, which is precisely what the index tracks.

Here's a gallery for the top 10 areas with the strongest demand:

This list might seem crazy: weren't most of these areas ground zero for the housing bust? Five of those listed are in Florida, including Broward and Palm Beach counties. Even Las Vegas makes the list.

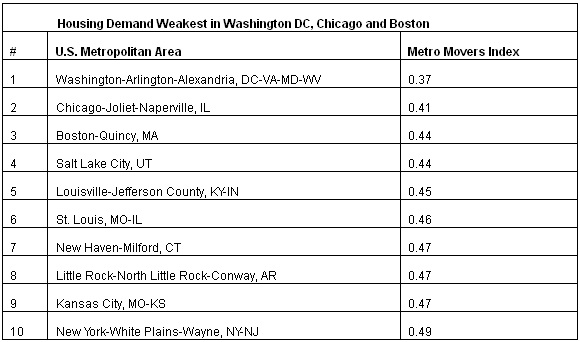

If you find this surprising, then you also probably find the list of the weakest areas just as strange. Here they are:

This list might also seem counter-intuitive. These housing markets have been relatively resilient compared to many others -- particularly compared to those that made the strongest demand list above.

Demand Is Not the Whole Story

What's going on here? Well, part of the problem is that this index only monitors demand. Supply also comes into play when we're talking about the health of an area's housing market. In areas less affected by the housing bubble's pop, like New York and Washington, the available supply is much smaller. As a result, even relatively weak inbound home buying demand can keep prices stable or rising.

Also, although the churn created by current residents that are looking to buy or sell homes within their own metro area was brushed off above, it can still help to keep prices stable. Quick turnover means that homes aren't remaining listed for long so that home values remain resilient or are rising.

Consumers Love Deals

But another factor matters here. Although a decline in home prices might be bad for the current inhabitants of a metro area, it's great for those considering moving into the region -- and that's what the Trulia index measures. Think about it: if you live in Manhattan where home prices continue to rise and you know that prices have been falling on Long Island, then it happens to be a particularly good time to think about moving out of the city. That's what Trulia is tracking.

The company's Chief Economist Jed Kolko uses this logic to explain the potentially surprising results of this report. He notes that the index has a very strong correlation to the drop in prices from peak to trough. So the farther prices have fallen since the bubble popped, the more demand from consumers looking for deals. Alternatively, the better prices have held up, the more likely current residents are considering moving out to the suburbs or elsewhere. There are exceptions to this rule, but it tends to hold pretty well.

And it makes sense. Savvy consumer look for deals, and if you know enough to look at a website like Trulia for home listings, then you have probably discovered that moving a little further out of town can get you a lot more for your money -- especially now. Of course, this is also good news for those areas hit hardest by the bust. Even as their home prices continue to recede, strong outside demand will grow. Eventually, this will help the market to reach equilibrium so that prices can eventually stabilize.

Image Credit: Dave1276 / Shutterstock

More From The Atlantic