Novo Nordisk (NVO) Q1 Earnings In Line, Sales Miss, View Up

Novo Nordisk A/S NVO reported first-quarter 2023 earnings of $1.27 per American Depositary Receipt, which came in line with the Zacks Consensus Estimate. The company reported earnings of 94 cents in the year-ago quarter.

Revenues of $7.69 billion missed the Zacks Consensus Estimate of $7.86 billion. Sales increased 27% year over year, driven by higher Diabetes and Obesity care sales as GLP-1 sales improved.

Shares of Novo Nordisk have gained 48.8% compared with the industry’s rise of 12.6%.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-over-year basis and at constant exchange rates (CER).

Quarter in Detail

Novo Nordisk operates under two segments: Diabetes and Obesity Care and the Rare disease segment.

The Diabetes and Obesity Care segment’s sales were DKK 48.8 billion, which represents growth of 31%. In Diabetes Care, fast-acting insulin, Fiasp’s revenues were up 3%. NovoRapid revenues were down 10%. Human insulin revenues were also down 11%. Premix insulin (Ryzodeg and NovoMix) revenues declined by 7%. Also, sales of long-acting insulins (Tresiba, Xultophy and Levemir) decreased 14%.

Ozempic, which has witnessed a strong launch and a solid uptake so far, recorded sales of DKK 19.64 billion for the quarter, up 59%. Rybelsus too witnessed a strong uptake and recorded sales of DKK 4.36 billion for the quarter, up 107%.

Obesity Care (Saxenda and Wegovy) sales were up 124% year over year. Wegovy sales increased significantly after the company solved supply issues in the United States for the drug. All dose strengths of Wegovy were made available in the U.S. market in December 2022. Novo Nordisk also reported that a second contract manufacturer for Wegovy initiated production in April 2023.

Sales in the Rare disease segment were down 16% year over year to DKK 4,576 million. Sales of rare blood disorder products were DKK 3,049 million, down 3%. Sales of hemophilia A products increased 19%. Hemophilia B products’ sales were also up 15%. Sales of NovoSeven were down 11% to DKK 2,101 million.

Sales and distribution costs climbed 22% in DKK and increased 20% at CER year over year. This increase was due to International Operations and North America Operations owing to Wegovy relaunch, promotional activities related to Ozempic and Rybelsus as well as Obesity care market development activities.

Research and development costs were up 29% in DKK and increased 28% at CER from the year-ago quarter figures. Higher costs were driven by clinical activity for late-stage studies and increased early research activities compared to the first quarter of 2022.

Administrative costs increased 10% in DKK and were up 9% at CER from the year-ago quarter’s figures.

2023 Outlook Updated

For 2023, the company now expects sales to grow 24-30% (earlier estimate – 13-19%), while operating profit is now expected to register 28-34% growth as compared with the earlier forecast of 13-19%.

The increase in guidance primarily reflected Wegovy prescription trends in the first quarter and higher full-year expectations for sales of Wegovy in the United States. Additionally, a second contract manufacturer of Novo Nordisk is now ready to begin production, which is anticipated to increase Wegovy’s supply capacity.

Our Take

Novo Nordisk's first-quarter earnings matched estimates while revenues missed on the same. Ozempic and Rybelsus have experienced great traction in the market since launch and are expected to drive growth in the upcoming quarters. Saxenda, too, has witnessed strong uptake so far.

The extension of the existing indication by the European Medicines Agency for Wegovy in March 2023, coupled with increased prescription trends and supply capacity, is likely to boost sales of the drug.

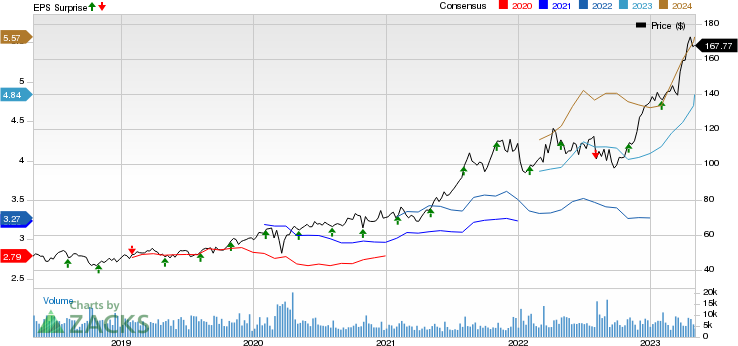

Novo Nordisk A/S Price, Consensus and EPS Surprise

Novo Nordisk A/S price-consensus-eps-surprise-chart | Novo Nordisk A/S Quote

Zacks Rank & Other Stocks to Consider

Novo Nordisk currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked companies in the medical industry are Sanofi SNY, Aptinyx APTX and ADMA Biologics ADMA, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here

In the past 90 days, the Zacks Consensus Estimate for Sanofi’s 2023 earnings per share has increased from $4.48 to $4.49. In the past year, shares of Sanofi have increased by 5.3%.

SNY’s earnings beat three out of the trailing four reported quarters, missing the mark on one occasion, witnessing an average earnings surprise of 5.05%

In the past 90 days, the Zacks Consensus Estimate for Aptinyx’s 2023 loss per share has narrowed from 77 cents to 47 cents. In the past year, shares of Aptinyx have fallen by 86.9%.

APTX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 6.56%.

In the past 90 days, the consensus estimate for ADMA Biologics’ 2023 loss per share has narrowed from 19 cents to 14 cents. In the past year, shares of ADMA Biologics have increased by 85.1%.

ADMA beat estimates in three out of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 2.88%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Aptinyx Inc. (APTX) : Free Stock Analysis Report