Bayer (BAYRY) Inks Deal to Develop Therapies for Eye Diseases

Bayer Aktiengesellschaft’s BAYRY wholly-owned subsidiary, BlueRock Therapeutics LP, FUJIFILM Cellular Dynamics, Inc. and Opsis Therapeutics, LLC, announced that they have entered into a strategic research and development alliance to discover and develop cell therapies for eye diseases.

The companies are looking to combine their respective expertise to discover and develop off-the-shelf induced pluripotent stem (iPS) cell therapies for addressing ocular diseases.

Per the deal, BlueRock will have the option to exclusively license three retinal cell therapy programs focused on dry age-related macular degeneration (“AMD”) and inherited retinal diseases (IRDs) containing human retinal pigment epithelial cells and photoreceptor cells, that are currently in pre-clinical studies.

The deal looks a good strategic fit for Bayer’s mission to develop a new generation of cellular therapies which complements FUJIFILM CellularDynamics and Opsis Therapeutics’ mission to create best-in-class cell replacement therapies for degenerative retinal diseases like AMD and IRDs.

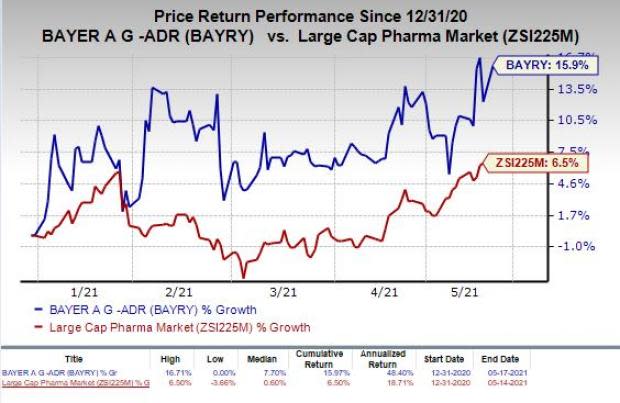

Shares of Bayer have rallied 15.9% so far this year compared with the industry’s 6.5% growth.

Per the press release, AMD is the leading cause of irreversible blindness and visual impairment in the world while IRDs are a leading cause of vision loss in people aged between 15-45 years.

We note that Bayer’s HealthCare unit has co-developed Eylea with Regeneron Pharmaceuticals REGN. The drug is approved in the United States, EU, Japan and other countries for the treatment of neovascular age-related macular degeneration (wet AMD), diabetic macular edema (DME) and macular edema.

Notably, Regeneron is solely responsible for sales of Eylea and is entitled to profits made in the United States. However, it shares profits and losses from the ex-U.S. Eylea sales equally with Bayer, except in Japan where the former receives a royalty on net sales.

Zacks Rank & Stocks to Consider

Bayer currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the healthcare sector include Athenex, Inc. ATNX and Adaptive Biotechnologies Corporation ADPT, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Athenex’s loss per share estimates have narrowed 21.8% for 2021 and 23.2% for 2022 over the past 60 days.

Adaptive Biotechnologies’ loss per share estimates have narrowed 11.7% for 2021 and 2.3% for 2022 over the past 60 days.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Athenex, Inc. (ATNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.