Iovance (IOVA) Announces Lung Cancer Study Data on TIL Therapy

Iovance Biotherapeutics, Inc. IOVA announced promising initial data from a cohort — Cohort 3B — of its ongoing phase II basket study, IOV-COM-202, evaluating single administration of its tumor infiltrating lymphocyte (TIL) therapy candidate, LN-145, in patients with metastatic non-small cell lung cancer (mNSCLC).

Data showed that LN-145 monotherapy achieved an objective response rate (ORR) of 21.4%, including one complete response (CR) and five partial responses. Moreover, data also showed a disease control rate of 64.3%. Meanwhile, median duration of response has not been achieved at the median follow-up of 8.2 months. The company plans to present additional data from the Cohort 3B at a medical meeting in the second half of 2021.

Please note that the Cohort 3B of the study is evaluating LN-145 in mNSCLC patients whose disease has progressed following treatment with immune checkpoint inhibitor (ICI) therapy, including tyrosine kinase inhibitors in patients with oncogene-driven tumors.

LN-145 achieved a better ORR as second-line treatment for NSCLC patients compared to treatment with ICI therapies of ICI-naïve patients whose disease has progressed following treatment with chemotherapy. However, the data from the IOV-COM-202 study seems to fail market expectation as shares fall after the announcement. Some analysts noted that data from a small academic study at Moffitt evaluating an investigational TIL therapy demonstrated an ORR of 25% with two CRs, which was higher than the improvement achieved by LN-145.

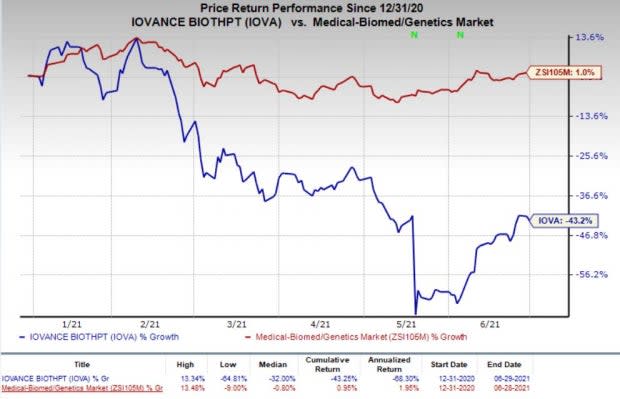

Shares of Iovance were down 2.2% on Jun 29, following the study data readout. However, the company’s shares have declined 43.2% so far this year against the industry’s increase of 1%.

Image Source: Zacks Investment Research

Although IOV-COM-202 study data failed to boost investor enthusiasm, we note that study participants were more in the Iovance’s study compared to Moffitt’s study. Increasing the number of study participants in the Moffitt’s study may affect ORR as well as other study endpoints.

We note that the IOV-COM-202 is also evaluating LN-145 and other TIL therapy candidates across several oncology indications. The study is evaluating a combination of LN-145 and Bristol-Myers’ BMY Opdivo (nivolumab) and Yervoy (ipilimumab) in patients with recurrent or metastatic NSCLC in patients who have previously been treated with a checkpoint inhibitor monotherapy. Another combination of LN-145 with Merck’s MRK Keytruda (pembrolizumab) is being evaluated in patients with unresectable or metastatic NSCLC or patients with head and neck squamous cell carcinoma who have not received prior immunotherapy. The study is also evaluating other TIL therapies namely lifileucel in combination with Keytruda, LN-144 monotherapy and LN-145-S1 monotherapy in melanoma patients.

Iovance also announced that it has dosed the first patient in its registration-enabling phase II study — IOV-LUN-202 — that will evaluate LN-145 in second-line mNSCLC where patients have progressed after one prior ICI and chemotherapy. The study will evaluate LN-145 in NSCLC patients with tumors that do not express PD-L1 as well as patients whose tumors express PD-L1 in separate cohorts.

Meanwhile, we note that the company is also focused on developing potency assays for lifileucel to support its approval for melanoma indication. Last month, Iovance announced that the company needs to continue its ongoing work developing and validating its potency assays for lifileucel, following feedback from the FDA on its previously submitted assay data. The company plans to submit an additional assay data to the FDA in the second half of 2021, thus delaying its potential BLA submission for lifileucel for melanoma from 2021 to the first half of 2022.

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stock to Consider

Iovance currently has a Zacks Rank #4 (Sell).

BioNTech SE BNTX is a better-ranked stock from the biotech sector, carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BioNTech’s earnings per share estimates have increased from $30.71 to $30.85 for 2021 and from $25.05 to $25.20 for 2022 in the past 30 days.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.