'Our number is bad': Over a million small business workers could lose jobs amid coronavirus

A majority of U.S. unemployment benefit claims filed in the wake of the coronavirus outbreak could come from employees of small businesses, according to one estimate — further hurting a sector that has been losing ground to major corporations over the past several decades.

“Our number is bad. It’s in the millions,” Steve King, Director for Emergent Research, told Yahoo Finance about his firm’s projections for unemployment insurance claims expected over the coming weeks and months.

In past recessions, small firms have laid off people faster than bigger firms, resulting in a relatively high share of early applicants for unemployment benefits, according to King, whose firm focuses on the small business economy.

“Based on what we are seeing and hearing, this is happening again,” King said, cautioning that until the data starts coming out over the next couple of weeks the projection is uncertain. “Our guess would be somewhere around 60%-70% of the unemployment insurance claims over the next few weeks will come from employees of small businesses.”

Bank of American on Friday said it estimates 3 million total jobless claims to be filed for the week ending March 21. Over the next two to three weeks, Emergent estimates 2 to 3 million claims for unemployment insurance.

And over the next two to three months, if the shutdown of many businesses persists, Emergent estimates 24 million workers will file, representing nearly half of the 58 million Americans who work for private companies with fewer than 500 employees. The numbers do not include the full- and part-time gig workers who are ineligible for unemployment compensation.

‘Small business formation has been in decline’

Members of the National Federation for Independent Business (NFIB) are expressing great concern over keeping their doors open, according to Holly Wade, director of research and policy analysis for the small business advocacy organization. A slide in the number of existing small firms would exacerbate their already waning stake in the U.S. economy, she added.

“The churn of small business formation has been in decline for decades now,” Wade said. “And that's been the focus of a lot of academic research to figure out why this trend is happening.”

“So when we go through something like this, an economic crisis, like we did with the financial crisis, on the other side, we want to make sure that the landscape to start a business and define market opportunities is easily accessible and that there are very low barriers to entry to get the small business sector moving again,” Wade said.

The majority of firms will need to make quick decisions about whether to remain in business because most keep 30 days of full reserves, King said, noting that labor-intensive companies such as restaurants tend to keep less in reserves.

Why small businesses need a lifeline

On Thursday, lawmakers introduced a new relief package proposal with additional life lines for small businesses, including $300 million in stimulus funds, part of which offers grants and loans to certain small businesses that keep their employees on their payrolls during the crisis, and penalty-free delays for tax filings and payments. The Small Business Administration also began approving disaster loans to eligible applicants.

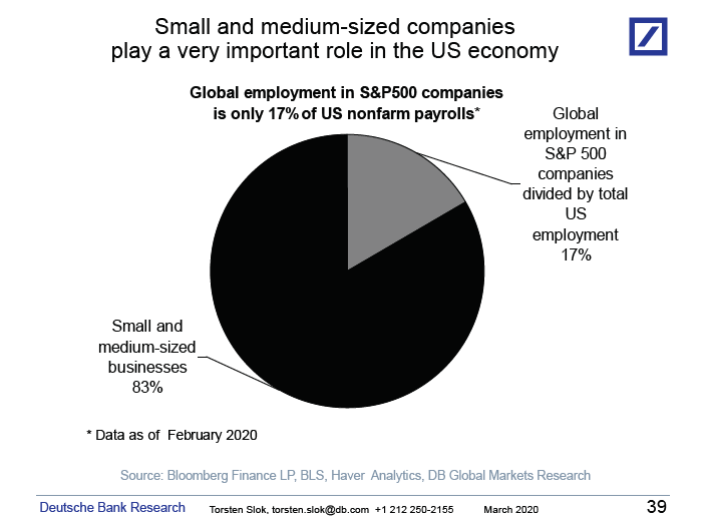

In an email Deutsche Bank Securities Chief Economist, Torsten Slok, emphasized the critical need to keep small business afloat. “The U.S. economy mainly consists of small businesses...and this is a challenge in a situation where policymakers want to quickly get money into the hands of the corporate sector either via fiscal policy or monetary policy.”

On Thursday, jobless claims for the week ending March 14 jumped to 281,000 from 211,000 the prior week. The 33% increase outpaced the largest increase during the Great Recession of 14%. But those numbers fail to represent the reality of what’s coming, King said.

“Based on everything we're hearing, this week started the layoff week,” he said. “I don't think it will be reflected in the numbers for another two weeks.”

“With an average of 30 days reserves, if your revenue is cut by 50 or 60% you're gonna have to move quickly and you're gonna have to lay people off,” King said. “The good news is there's a bunch of businesses that aren't shut down.”

‘The mergers will come’

Still, the eventual recovery could lead to even more consolidation of businesses, Mark Cooper, CEO of P.J. Solomon, told Yahoo Finance’s The First Trade, noting that mergers typically happen after a downturn.

“The mergers will come, in my view, in a few flavors. One will be ... in difficult industries like retail and site-based oriented businesses, movie theaters, amusement parks, and the like. Those might have companies coming together to show greater strength and have synergies in order to withstand the difficult marketplace,” he said.

Already, bigger businesses seem to be benefitting from the coronavirus shutdowns even as small businesses suffer. This week, mega corporations Walmart (WMT) and Amazon (AMZN) announced they planned to hire due to a surge in business. Walmart said it would bring on 150,000 workers, while Amazon reported plans to hire 100,000 full- and part-time warehouse workers.

Read more:

COVID-19 could make a resurgence this fall depending on U.S. response

What to do if you are laid off from work due to COVID-19

The U.S. government clarifies when workers must get paid amid coronavirus shutdowns

Alexis Keenan is a New York-based reporter for Yahoo Finance and former litigation attorney.

Follow Alexis Keenan on Twitter @alexiskweed.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.