'Walking a very thin line': Why coronavirus could hit small businesses the hardest

Keeping the U.S. economy on its feet as coronavirus pervades American borders is up to consumers and how much they’re willing to go out and spend, especially at small and midsize businesses, supply chain management expert Hitendra Chaturvedi says.

Chaturvedi, a professor at Arizona State University’s W.P. Carey School of Business, said he’s not worried about major U.S. firms’ resilience to partial, or even full-year profit flatlines, and instead sees protecting smaller companies as key.

“Small and medium-sized businesses (SMEs) that are the heart and soul of this country are the ones that are going to be the hardest hit,” Chaturvedi told Yahoo Finance on Friday. “Even when things improve, they’re walking a very thin line here.”

‘All their eggs are truly in one basket’

The delicate balance arises from business models that, unlike major firms, lean heavily on single suppliers and run on tight cash reserves.

“All their eggs are truly in one single basket. With a hit like this, their entire supply gets impacted,” Chaturvedi said of SMEs that rely on supplies from China.

Challenges can compound, he said, because the needs of smaller buyers are de-prioritized by suppliers in favor of larger volume buyers. Keeping their heads above water becomes even more challenging because small firms typically lack cash reserves that would allow them to pivot to suppliers in India and elsewhere, or to diversify purchases between suppliers.

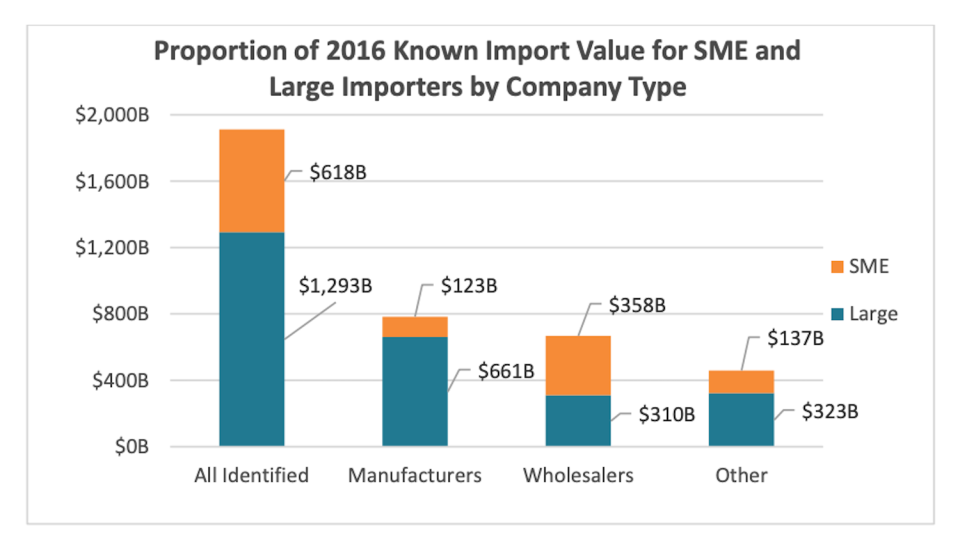

According to 2016 census data, small and medium U.S. enterprises (SMEs) imported a third of all U.S. imports, representing $618 billion in goods.

“60% to 70% of the economy is driven by consumer spending. If panic sets in and if you don't go out, consumer spending, which is the backbone of this economy, is going to be hit, and that is what's causing the stock market to behave the way it is,” Chaturvedi said.

Former New York Stock Exchange floor trader and founder of Sarge986 LLC, Stephen Guilfoyle, argued that the Federal Reserve should immediately increase short-term liquidity for small business. On Friday, Guilfoyle told Yahoo Finance’s The First Trade that the Fed should hold an emergency meeting and reduce interest rates by 50 basis points.

“Why this is important is because nothing is more important than the velocity of money. Nothing is more important to preserving jobs. Nothing is more important to keeping small businesses right now from going under, as they can't get the supplies that they need to make sales now,” he said.

On Friday, Federal Reserve Chair Jay Powell published a statement maintaining that the fundamentals of the U.S. remain “strong,” and said that the central bank recognized the coronavirus as an evolving risk to economic activity. Powell said the agency was “closely monitoring developments and their implications for the economic outlook” and would use its tools to act as appropriate to support the economy.

‘A sharp slowdown in world growth’

On Monday, Laurence Boone, Chief Economist for the Organisation for Economic Co-operation and Development (OECD), a non-profit organization focused on stimulating international economic progress and world trade, said in addition to supporting healthcare systems, governments need to “shore up demand and provide a financial lifeline to households and businesses that are most affected.”

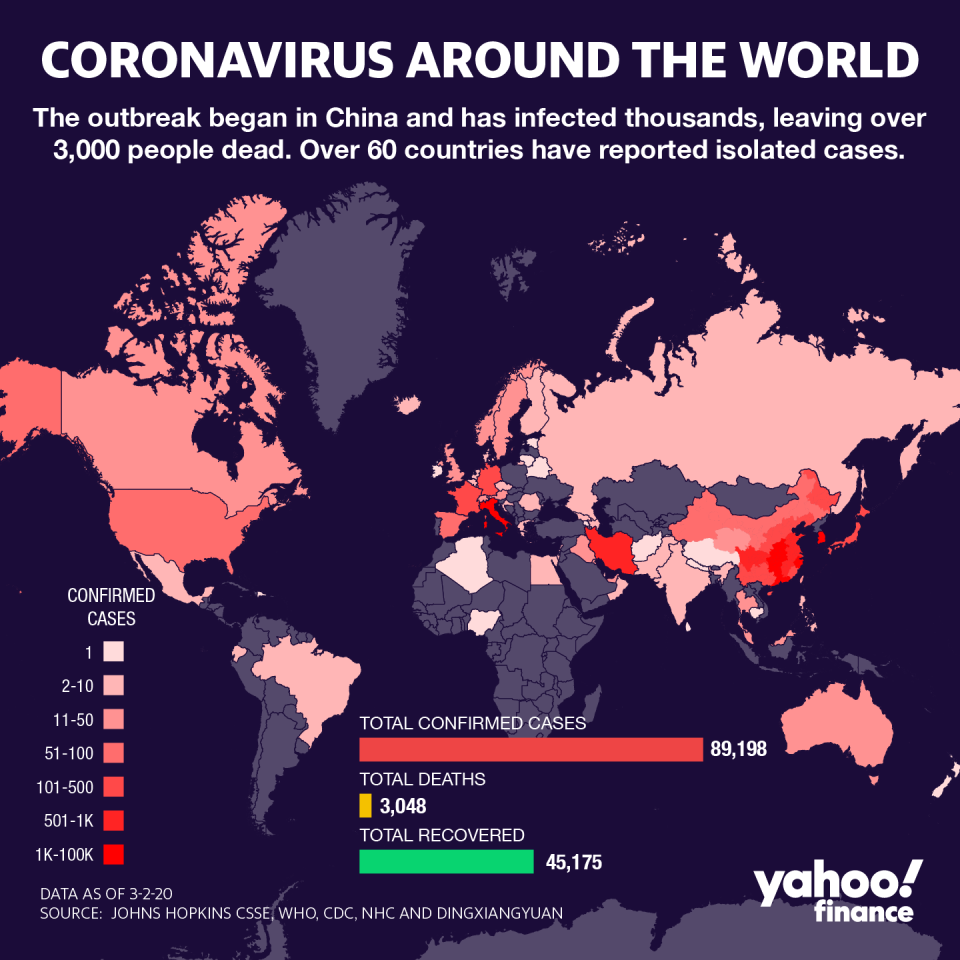

“Even in the best-case scenario of limited outbreaks in countries outside China, a sharp slowdown in world growth is expected in the first half of 2020 as supply chains and commodities are hit, tourism drops and confidence falters,” OECD said in an online statement. “Global economic growth is seen falling to 2.4% for the whole year, compared to an already weak 2.9 % in 2019. It is then expected to rise to a modest 3.3% in 2021.”

For Chaturvedi, the best case scenario is that the spread of coronavirus is curbed by the end of March. In that case, he said he believes a significant rebound will follow. “I'm looking at the end of March, because then you can look forward to the second, and the third, and the fourth quarter. On the other end of the spectrum is the virus starts to spread significantly across the U.S.,” he said. “For me, that’s the worst case scenario, because ... panic will spread faster than coronavirus.”

Alexis Keenan is a reporter for Yahoo Finance. Follow her on Twitter @alexiskweed.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and Reddit.