Why everybody turned 'end of the world bearish' this week

There’s a consistent pattern that tends to occur with market sentiment and it happened again this week.

Here’s the pattern: The market has a nice uptrend that usually lasts 6-12 weeks. The rally usually stalls when the market and its leading stocks get a little too extended technically, and when bullishness increases based on many sentiment measures. We then see a decline until sentiment reaches extreme bearish levels or drops very suddenly. After stabilizing, the market tends to grind back up and embarrass all the people who reduced exposure, loaded up on put options, or turned “end of the world” bearish.

The reason I pay so much attention to sentiment is that the market is never obvious and tends to fool the majority. The difficult part about interpreting sentiment is that sometimes this jump in bearishness happens quickly, as it did this week, and other times it takes a while. For example, in the fall of 2018 market participants got very complacent after being conditioned to buy the dip for so long. The market kept sliding the entire quarter until sentiment reached extreme bearish levels near the end of December 2018.

Here are some examples of the sentiment measures that quickly turned bearish after this recent decline:

The NAAIM Exposure Index which measures the average exposure to US equity markets by its members saw an extreme drop from 91.41 to 56.59. (Via StockCharts.com)

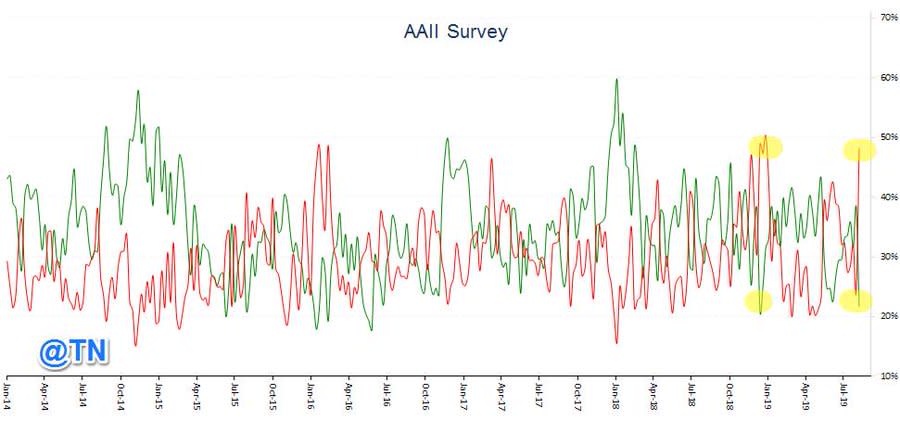

AAII weekly retail investor sentiment shifted dramatically to pessimistic levels not seen since late 2018. Bulls 21.7% (drop of 16.8% points) and Bears 48.2% (rise of 24.1% points). (Via @TN).

The flight to bonds and out of the S&P 500 index over the past 10 days reached an extreme. (Via @McClellanOsc).

The CBOE Options Total Put/Call Ratio rose to elevated levels over the past week. (Via StockCharts.com)

What’s more fascinating to me is WHY this happens? There are several possible reasons. 1) Many people are becoming macro economists and over-thinking fundamentals rather than focusing on what the big institutions are doing. After all, they control the market, not the economists.

2) Many feel this recovery has gone on for too long and will end any day now, so they always have one foot out the door. Keep in mind the economy has recovered slowly and steadily for the past 10 years, but the stock market has seen 20% corrections in 2011, 2018, and a brutal bear market beneath the surface from mid-2015 through mid-2016.

3) I hate to bring up politics but many people can’t stand President Trump and want the stock market to fail in order to see him not get re-elected. As Warren Buffett says: “If you mix politics with your investment decisions you’re making a big mistake.”

4) The financial crisis of 2008-09 is still fresh in people’s minds. Therefore, any small correction leads many to rush for the exits in order to prevent a possible larger decline in their portfolios.

5) Many disagree with the actions of the Federal Reserve and the global central banks and feel that their easy money policies will eventually lead to a collapse.

Whatever the reason, it’s important to keep a level head during periods of market volatility and to not make investment decisions based on emotions. The two main drivers of the stock market are earnings and interest rates. Right now, earnings are growing steadily and it is really difficult to fight the globally coordinated effort by central banks to keep interest rates low and the markets high. In addition, this consistent fear that creeps into the markets on any little correction is what will keep us propped up for a while. After all, the markets are never obvious and they tend to fool the majority.

I can be reached at: jfahmy@zorcapital.com

Read more:

The market owns the Fed, and that’s why it’s cutting rates

Why the market will head higher into year end

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.