Amex unveils new payment feature for credit cards

Retail stores use layaway to help customers pay for purchases. Now it looks like credit card companies are getting in on the action.

On Wednesday, American Express (AXP) unveiled its new “Plan It” feature, which will give card members the opportunity to pay off large purchases over a fixed period of time.

Using the American Express app or on AmericanExpress.com, card members can select any purchase over $100 and choose a payment plan. A fixed monthly fee will be charged instead of accrued interest on the entire bill calculated by the card’s annual percentage rate (APR).

Plan It lets customers pay off large purchases overtime.

“For larger purchases, we developed Plan It to give card members another way to pay over time with a “no surprises” plan that offers transparent, monthly payments for a fixed fee,” said Kartik Mani, head of Global Consumer Lending at American Express.

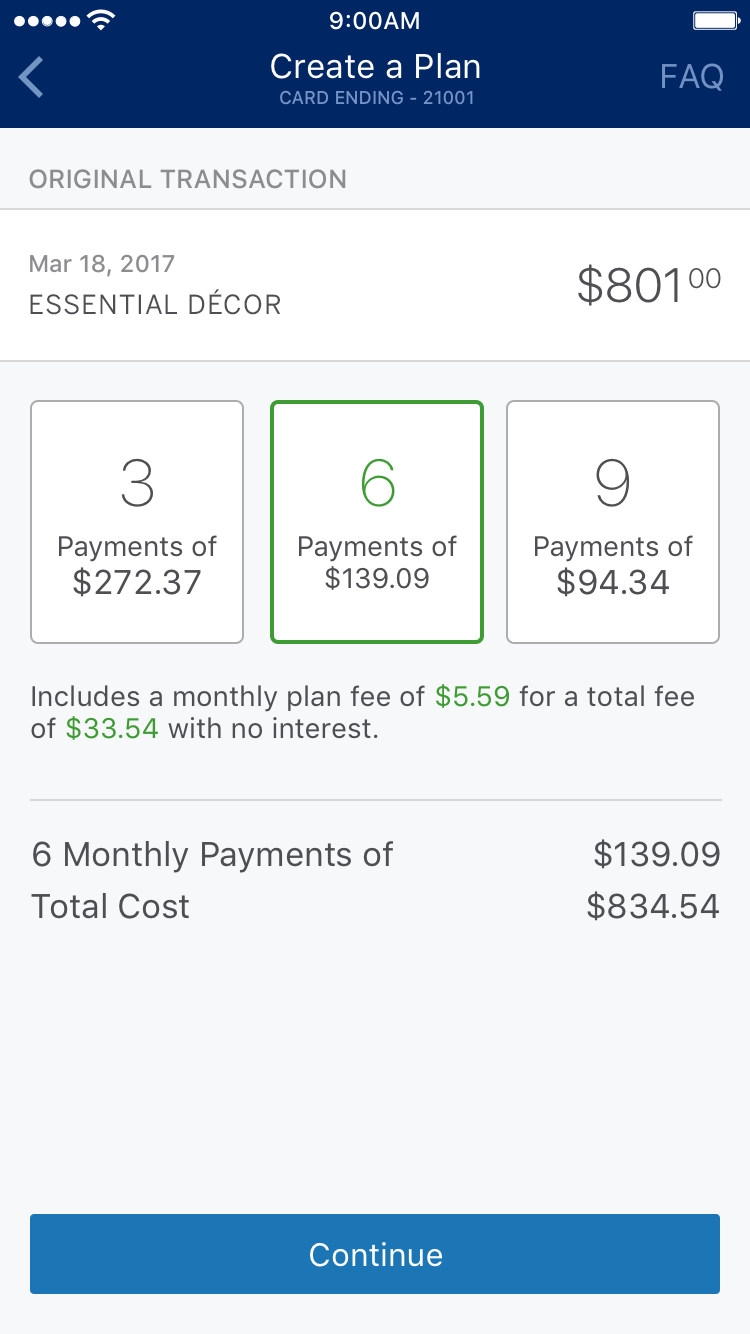

After clicking the “Plan It” icon, members will be presented with three different payment plans. Repayment terms range from three months to 24 months and the fixed fee is presented upfront.

For example, let’s say you just moved into a new home and spotted your dream sofa but it costs $801. You’ve already used your credit card to purchase essential items for your place and you want to keep your credit card balance low. You’d also like more time to pay for the sofa. With Plan it, you’ll get charged a fee of $5.59 per month and Amex will give you the option to make:

Three payments of $272.37

Six payments of $139.09

Nine payments of 94.34

For the six-month option you’ll end up paying a total of $834, all while keeping your credit card balance low. Once you choose the best plan for you, Plan It will be added to your monthly statement.

If you do not pay the minimum payment on time, which includes the Plan It monthly fee, you will incur late fees. If you consistently fail to make payments, your account may go into default.

Who should use ‘Plan It’

The benefits of using Plan It depends greatly on the individual. For consumers who routinely pay off their credit card balance every month, this feature would allow them to keep their balance low while paying off larger purchases in installments. “It’s a responsible way to borrow that puts consumers in control,” said an American Express spokesperson.

By putting the purchase in a separate plan, it could also mean avoiding higher interest rate charges typically added to credit card bills.

On the other hand, Plan It wouldn’t be ideal for people who make the minimum monthly credit card payments because you’re actually paying more for an item, since there’s an additional monthly fee.

In 2016, NerdWallet found that Americans had about $1 trillion in credit card debt, with the average family owing $8,377. In other words, misusing Plan It could lead some consumers to buy things they simply can’t afford.

“For others, especially those who are adding to their debt load as so many Americans currently are, it could end up being one more debt dragging down their finances,” said Kimberly Palmer, a credit cards expert at NerdWallet.

The Plan It feature is now available on a handful of U.S. personal credit cards, including the Amex Everyday Credit Card, Blue from American Express, Gold Delta SkyMiles Credit Card and the Hilton Honors card from American Express.

If your card was issued after June 1, Plan It will be added to your card in early 2018.

Brittany is a reporter at Yahoo Finance.

This is the best credit card for international travel

5 ways to protect your money from credit card skimmers

Travel credit card competition heats up with revamped AMEX Platinum