Sanofi (SNY) Q1 Earnings Top, Genzyme & Vaccines Drive Sales

Sanofi SNY reported first-quarter 2019 earnings of 81 cents per American depositary share, which beat the Zacks Consensus Estimate of 74 cents. Earnings increased 10.9% on a reported basis. At constant currency rates (CER), earnings grew 9.4%, driven by strong top-line growth.

First-quarter net sales of the French pharma giant rose 6.2% on a reported basis to almost $9.53 billion (€8.39 billion). Exchange rate movements benefited sales by 2%. At CER, sales increased 4.2% year over year. Sales however missed the Zacks Consensus Estimate of $9.73 billion.

In March 2018, Sanofi completed its acquisition of Bioverativ and in September it closed the agreement to sell its European generics business, Zentiva, to Advent International. Adjusting for the Bioverativ acquisition and the Zentiva divestiture, sales rose 3.8% at constant structure (CS) and CER basis.

Sales increased 7.1% at CER in the United States. At CER, sales rose 13.6% in the Emerging Markets and 8.3% in the Rest of the World (Japan, South Korea, Canada, Australia, New Zealand and Puerto Rico). However, sales declined 9.4% in Europe at CER.

All growth rates mentioned below are on a year-on-year basis and at CER.

Segmental Performance

Sanofi reported through five Global Business Units (GBUs) — Sanofi Genzyme (Specialty Care), Diabetes & Cardiovascular, General Medicines & Emerging Markets, Consumer Healthcare and Sanofi Pasteur (Vaccines).

However, beginning the first quarter of 2019, Sanofi implemented a new structure wherein the General Medicines & Emerging Markets and Diabetes and Cardiovascular GBU were reorganized into two new GBUs, namely the Primary Care unit and the China and Emerging Markets unit. Importantly, Emerging Markets sales for Specialty Care and Primary Care are now included in China & Emerging Markets GBU.

Pharmaceuticals sales (including the emerging markets) rose 3.1% to €6.26 billion driven by growth in Rare Blood Disorder and Immunology franchises, partially offset by lower Diabetes and Established Rx products sales and the Zentiva (European generics business) divestiture.

Sanofi Genzyme/Specialty Care GBU sales (excluding the emerging markets) increased 30.8% to €2.02 billion, driven by its eczema drug Dupixent and consolidation of Bioverativ. Sales rose 16% on a CS basis.

Sales of rare disease drugs increased 3.9% to €613 million driven by Gaucher and Pompe therapies. Important drugs like Myozyme/Lumizyme rose 6.5% to €188 million, Fabrazyme sales were €167 million, up 4.6%. Cerezyme sales declined 5.2% to €113 million.

Oncology sales increased 2.1% to €273 million. Key cancer drug Jevtana’s sales were up 6.4% to €105 million supported by growth in all regions.

In the immunology franchise, Dupixent generated sales of €326 million in the quarter, up 16.4% on a sequential basis. Sales were driven by continued growth in adult atopic dermatitis indication and the recent U.S. launch in asthma. In October, Dupixent was approved by the FDA for the asthma indication, which played a key role in driving sales of the drug higher this quarter. Sales of the drug in the United States were €266 million while the same in Europe were €36 million. New rheumatoid arthritis drug, Kevzara recorded sales of €30 million in the quarter compared with €31 million in the previous quarter.

Sales of multiple sclerosis drugs rose 4.6% to €507 million. Aubagio sales increased 10.9% to €421 million while sales of Lemtrada fell 18% to €86 million.

Rare blood disorders franchise, added to Sanofi’s portfolio with the acquisition of Bioverativ, fetched sales of €270 million. In February, Cablivi (caplacizumab) for the treatment of a rare blood disorder called acquired thrombotic thrombocytopenic purpura was approved by the FDA and was launched in the U.S. market in early April. Cablivi was approved by the European Commission in September last year. The drug generated sales of €5 million in Germany and France in the first quarter compared with €3 million in the previous quarter.

The Primary Care GBU comprises the Diabetes and Cardiovascular and the Established Rx Products segments. Sales in the Primary Care GBU declined 17% to €2.29 billion hurt by lower diabetes sales and Zentiva divestiture.

The Diabetes franchise (excluding the emerging markets) declined 15.9% to €849 million due to lower sales of key drugs — Lantus and Toujeo – in the United States

Sales of diabetes drugs in the United States declined 22.8% to €445 million due to pricing pressure and loss of Part D business. In Europe, it decreased 5.6% and in rest of the world it declined12.1%.

Lantus sales decreased 29.3% to €493 million in the first quarter. Lantus sales plunged 36.6% in the United States due to lower average net price and change in coverage with respect to Sanofi’s Part D business. In Europe, sales decreased 16% due to branded/biosimilar competition and patient switching to Toujeo.

Toujeo generated sales of €167 million in the reported quarter, down 4.1%. Sales rose 19.4% in the Europe while it declined 24.7% in the United States.

Admelog, a rapid-acting insulin, similar to Lilly’s LLY Humalog, which was launched in the United Sales in April last year, achieved sales worth €66 versus €57 million in the previous quarter.

In the cardiovascular franchise, Sanofi’s anti PCSK9 therapy, Praluent, garnered worldwide sales of €52 million in the reported quarter, up 6.4% as growth in Europe made up for the decline in the United States. U.S. Sales declined due to significantly higher rebates offered by Sanofi and Regeneron REGN to payers to improve access to the drug. Sales of the other drug, Multaq, in this franchise declined 7.8% to €77 million.

Sales of Established Rx Products came in at €1.31 billion, down 18.8% due to generic competition for Renvela/Renagel in the United States, lower sales of Lovenox in Europe and thedivestment of the European generics business, Zentiva.

Sales of China and Emerging Markets GBU rose 10.3 % to €1.96 billion

Consumer Healthcare GBU (including the emerging markets) sales were €1.26 billion, up 0.6% as higher sales in Emerging Markets were partially offset by lower sales in the more mature markets of United States and Europe. Non-core divestments also hurt sales in this segment.

Sanofi Pasteur (Vaccines) sales (including the emerging markets) rose 20.1% to €873 million driven by a strong performance of the Polio/Pertussis/Hib vaccines in Emerging Markets and Japan

Costs Rise

Selling, general and administrative expenses (SG&A) inched up 0.6% at CER in the quarter, reflecting investments in product launches. R&D expenses were up 4.9% at CER due to increased spending on late-stage pipeline. Costs incurred for the consolidation of Bioverativ and Ablynx acquisitions also induced higher operating costs in the reported quarter.

2019 Outlook

Sanofi still expects business earnings to grow between 3% and 5% at CER in 2019. It now anticipates a positive currency impact of around 2% on business earnings, compared with the earlier range of 1%-2%.

Our Take

Sanofi’s first-quarter 2019 results were mixed as it beat estimates for earnings but missed the same for sales. Double-digit growth in the Specialty Care and Vaccines unit and higher sales in Emerging Markets offset persistent sluggishness in Diabetes and Cardiovascular franchises due to lower demand.

Sanofi’s shares were up 2.5% in pre-market trading on Friday in response to the fairly decent results. However, so far this year, the stock has underperformed the industry. It has declined 5% in the said time frame compared with a 2.6% decrease for the industry.

Sanofi’s Specialty Care segment is on a strong footing with the recent FDA approvals of new drugs Libtayo and Cablivi, and Dupixent for its second indication in asthma. Particularly, we believe Dupixent could prove to be an important growth driver. The performance of the Vaccines and Consumer Healthcare franchises has also improved lately. However, weak performance of the Diabetes unit, generic competition for many drugs and slower-than-expected uptake of core products like Praluent are headwinds.

Another European pharma giant, AstraZeneca plc AZN also reported first- quarter 2019 results. It beat estimates for both earnings and sales.The company’s top line was driven by new drugs and emerging markets.

Zacks Rank & Stock to Consider

Sanofi currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

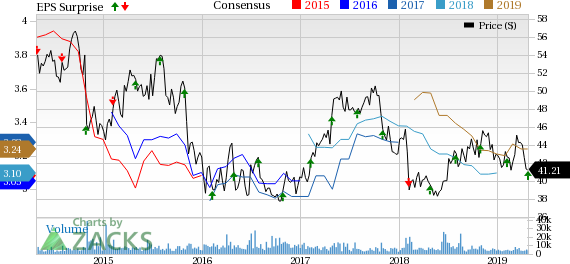

Sanofi Price, Consensus and EPS Surprise

Sanofi Price, Consensus and EPS Surprise | Sanofi Quote

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research