Veteran trader shares 11 market truths for stock investors

Eleven years ago, I wrote my first blog post on Alphatrends. I have been very fortunate that my work has been valued by readers and to have made it to this milestone. As you probably know, I like quotes. One of that I was lucky enough to value early on is, “Find something you love, and you will never have to work a day in your life.” I won’t say I have loved every single day of trading, but I truly enjoy the markets and sharing my insights on them.

Below are eleven truths about the markets which I think are worthy of an anniversary post:

1. Only price pays: For those of you who may not understand the concept, it means that the only thing that really matters, the only thing that determines success or failure in the market, is price action. You can try to justify a position or do complex analysis but it all comes down to price action.

2. Simplicity is the market’s greatest disguise: There is a tendency for many traders to complicate the process by doing “advanced” technical analysis, cluttering their charts with unnecessary indicators and oscillators. There is nothing wrong with having a pet indicator or two on your charts, but it all boils down to price action (See point number one.)

3. Volume is important: It reveals the urgency of buyers and sellers, but divergences are only a reason for caution, not a reason to act. You cannot take volume to the bank, and no one is going to ask you if you made your first million on light volume or heavy volume. Just the same, you cannot justify your losses by saying, “But it was on light volume!”

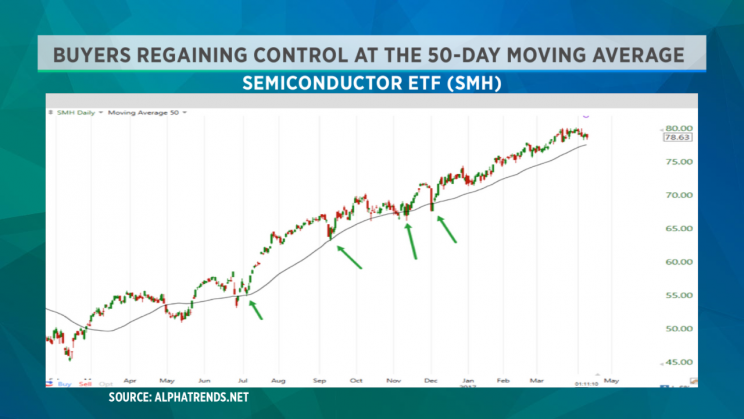

4. There is self-fulfillment in technical analysis: Think about the 50- or 200-day moving averages. Why do you think these moving averages “tend to” act as support or resistance? When a stock pulls back to meet a rising moving average, short sellers not only cease to short, but they begin to cover their positions. Longer-term holders of the stock place bids for more shares, hoping to add to a winning position. Profit takers slow down selling, and sidelined cash comes into the market looking to buy at a “smart place.” All of this action boils down to less supply and more demand at this level. The market is about supply and demand, and understanding the psychology of the participants allows us to anticipate their actions so we can formulate a low-risk strategy at these “levels of interest.”

5. Risk management is job #1: You will have losing trades—that’s a fact. Losses are part of the business. While no one likes to lose, if you can keep your losses small and have a strategy for holding on to winners, you will come out ahead in the long term.

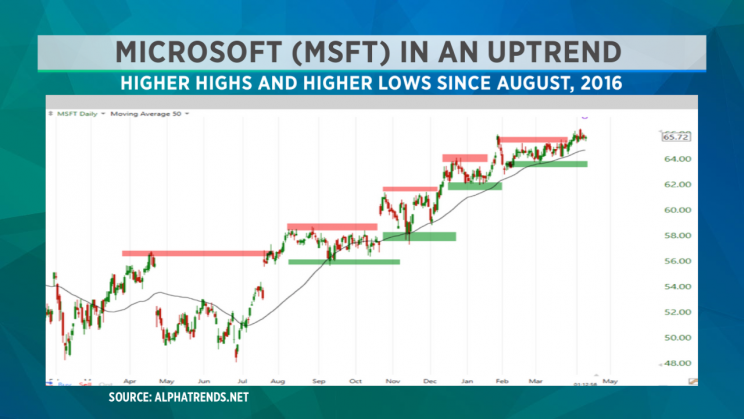

6. The trend really is your friend: As I like to say, “Stocks in uptrends are innocent until proven guilty; stocks in downtrends are guilty until proven innocent.” One of the biggest mistakes of participants is to buy into the hype of the Wall Street marketing machine, which says stocks like TWTR are “good” while the stock declines. Not to make it about Twitter, but I keep hearing that “it is a good company.” But for most Twitter holders since its IPO, it has been a losing trade. One day it will probably be higher, but for now it is a stock in a downtrend and buying as it declines is a losing strategy. You will have plenty of time to buy the stock as it recovers and goes higher. It is better to be late and right than it is to be early and wrong!

7. News and fundamentals do matter: Only a fool says that technical analysis or fundamental analysis has no value. It is closed-minded to discredit any analysis style that many market participants utilize and would put limits on your successes. I am a short- to intermediate-term trader, and most of my work is based on price analysis, but I have a general awareness of what news will act as a price catalyst. Perhaps the greatest danger is to believe that your opinion of a news event is more important than what the price action says about the stock.

8. As with any worthwhile endeavor, you need to work hard to succeed: I have built a trading community at Alphatrends and am amazed by people who think that they can join the community (or any other trading service) and expect to be told what to do and find success. I always encourage people to “make an idea their own”—regardless of where they find it. I may outline parameters for a trade on a certain stock, but it may not be appropriate for everyone. You have to take personal responsibility for your market decisions. Maybe you don’t like to trade stocks above or below a certain price level, maybe you want to place your stop wider or looser than what is suggested. When you find an idea, do some work. Make the trade your own!

9. This business attracts all kinds of characters, both good and bad: Fortunately, there are a lot of great people who mean well and really want to help. Unfortunately there are also a lot of charlatans in this business. These people are easy to recognize, as they tell you that they can make you rich with their secret systems. Steer clear of these people—anyone who tells you trading is easy is a liar!

10. Know your time frame: I prefer swing trades which take a couple of days to a couple of weeks. If you listen to the opinion of a fundamental trader who may be building a position over the period of months and expect that information to be useful in your shorter-term trades, you are probably going to be frustrated. Knowing your time frame means you must decide which information can be useful to you while you are in the trade. Let Warren Buffet build his positions, and maybe you can find a quick trade based on his comments, but he certainly isn’t interested in what happens to the stock in the next week or two, just as you may not be concerned about where the stock is trading in a year or two.

11. Day trading is NOT appropriate for most people: This may be the most controversial of these points. I have done tens of thousands of day trades over my career; many have been great, and I’ve also had some real stinkers. You have to be laser focused and make a lot of quick decisions. I have found that slowing down your decision making leads to better decisions. I will still take a day trade, but I am a lot choosier in which ones I take. It is my belief that the best time frame for active trading is the swing trading time frame of days to weeks.

Trade well and enjoy life!

~Brian

Read more from Brian Shannon

3 lessons from Bill Ackman’s $4B trading loss in Valeant

Biotech stocks are turning bullish—here’s how to profit