This is the best credit card for international travel

There are a few brand names that dominate the conversation when it comes to travel credit cards. Chase, American Express and Citibank all promise to offer the best perks and rewards, but a new study shows that another card outperforms them all.

According to a new report from Wallethub, the best credit card for international travel is the Barclaycard Arrival Plus World Elite MasterCard. This card comes with an $89 annual fee and 50,000 bonus miles worth $500 in travel after you spend $3,000 in 90 days.

One reason this card works well for travelers is because it lacks a foreign transaction fee, which can save you up to 3% on every purchase you make while abroad.

Across the board, 3 of the 10 largest credit card issuers don’t charge a foreign transaction fee on any of their cards, including Capital One, USAA, and Discover. For the others (Barclays, MC, Amex, Citi), some cards do charge these fees.

Beyond that, the World Elite MasterCard also performs really well when it comes to convenience services, like financial assistance in case of travel emergencies, financial assistance if the card is lost or stolen, and international merchant acceptance (how many countries accept the card).

Another topic that falls under the umbrella of “convenience services” is access to a PIN. In recent years, credit card issuers in the US have introduced chip and sign cards to make transactions more secure. Europe and other international destinations use chip and PIN technology, which requires customers to enter a 4- or 6-digit number when using their card at a self-service terminal, like a parking garage kiosk.

The majority of chip credit cards issued in the US don’t come with a PIN, but the Barclaycard Arrival Plus World Elite Mastercard does, allowing you to seamlessly use your card anywhere around the world.

Popular travel cards like the Chase Sapphire Reserve and Citi Prestige do not come with PIN technology, so travelers may have issues using these cards at certain locations internationally. It’s always good to carry some cash in local currency for situations like this.

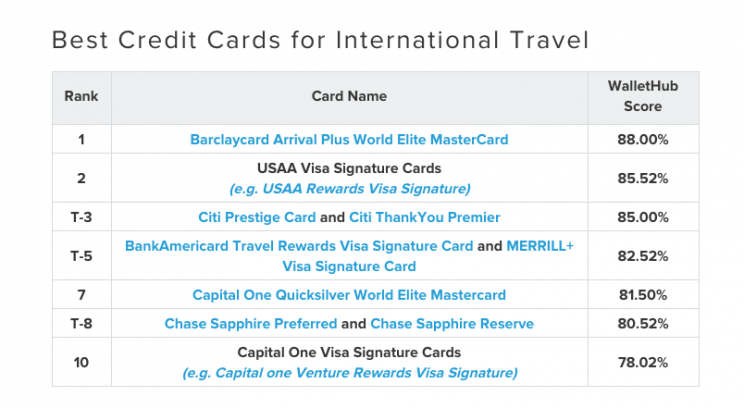

Wallethub analyzed 69 cards from the top 10 issuers for this study, which has a maximum score of 100%. The World Elite Mastercard earned a score of 88%, followed by the USAA Rewards Visa Signature with a score of 85.52%. Both the Citi Prestige and Citi ThankYou Premier cards scored 85%, thanks to their high marks in secondary benefits like luggage insurance, travel emergency assistance, and rental car coverage.

Another area analyzed were alerts, where American Express and Capital One were revealed as the only issuers that automatically detect when you travel and do not require notification.

This study is a good reminder that some credit cards will promote enticing rewards, like access to airport lounges and hefty sign-up bonuses, but may not provide important services for international travel, like a PIN or assistance during travel emergencies.

Be sure to research your card’s international features before you travel, so you don’t get stuck overseas with a card that doesn’t work or charges you extra for every purchase.

See full results of the Wallethub study.

Brittany is reporter at Yahoo Finance.

Is Chase Sapphire Reserve the best travel credit card ever?

The real reason why some stores still don’t take chip credit cards