Blockchain takes shot at Coinbase and other crypto exchanges: 'They kind of all look the same'

Blockchain, the company launched in 2011—not to be confused with blockchain, the technology—was one of the earliest bitcoin startups and is best known for its public blockchain explorer page and its free bitcoin wallet software. The company says it has more than 40 million bitcoin wallets in use.

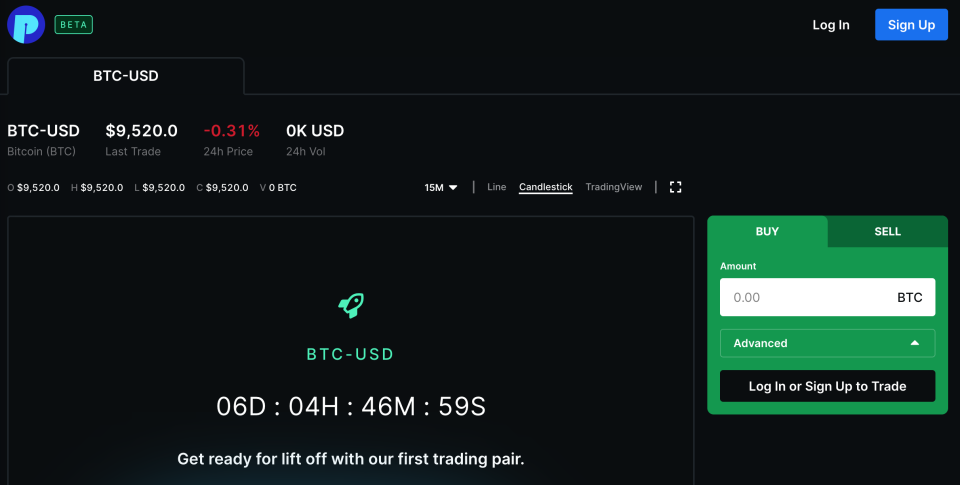

Now it’s launching a high-speed crypto exchange called The PIT, which will make Blockchain a direct competitor to Coinbase, Binance, Gemini, Kraken, and many more.

So, why get into the crowded business of bitcoin exchanges?

“There are a lot of players in this space,” acknowledges Blockchain’s head of retail products Nicole Sherrod. “But our perspective is, they kind of all look the same. If you look at the front-end trading technology, features, layouts, everything kind of looks the same.”

Indeed, Blockchain cofounder and CEO Peter Smith, in the company’s press release, frames it more aggressively: “The current crypto exchange market is outdated, broken, and skewed against users,” he says.

In an additional blog post announcing The PIT, Smith writes: “I’ve personally been using exchanges since 2011 and haven’t seen much improvement. They are unreliable, illiquid, and often unfair... On top of all this they are overly complex.”

The exchange is a clear effort to keep Blockchain wallet customers in the Blockchain ecosystem. Smith writes that he was tired of watching millions of users transfer their crypto from Blockchain wallets to external exchanges.

Blockchain says it has been working on The PIT for over a year and it has been in stealth mode. Sherrod, a former managing director of trading at TD Ameritrade, joined Blockchain in July 2018 without publicly announcing her job move until now. She says The PIT will “redefine the category” of crypto exchanges by solving three key problems: “speed, liquidity, and reliability.”

Speed in particular is the clear thrust of Blockchain’s pitch here: Its press release promises that The PIT is “the fastest crypto exchange in the world” and “the first microsecond-latency crypto exchange.” It will launch with support for 23 cryptocurrencies, and fiat-to-crypto trading for U.S. dollars, euros, British pounds.

“Where others are measuring speed in terms of milliseconds, we are defining the category in terms of microseconds,” Sherrod says.

To market the launch of The PIT, Blockchain even released a TV ad with celebrity William Shatner, a known bitcoin enthusiast. In the ad spot, Shatner tries to rob a bank, and complains, “We tried trading crypto, but our exchange was so slow.”

Of course, everything happening in the cryptocurrency industry this summer is happening against the backdrop of Facebook’s announcement of Libra, and the instantaneous government scrutiny and backlash to its plans.

Facebook (FB) executive David Marcus, who is overseeing Facebook’s digital wallet product Calibra, faced two days of questioning from members of Congress and the Senate. The general reaction from many cryptocurrency entrepreneurs and pundits outside of Facebook has been to argue that Libra is good for the whole space, since it brings crypto into the mainstream.

“Libra is net good for bitcoin,” said Alex Adelman, CEO of the bitcoin shopping rewards site Lolli. “It drives attention, and it validates bitcoin more than ever.” Jeremy Allaire, CEO of payments app Circle, is more cautious. He says Libra “has tremendous potential to reach billions of people” but it also “does bring more attention to the policy issues, and that's a double-edged sword.”

When asked about regulation, specifically of crypto exchanges, Blockchain’s Sherrod says, “The way that we’ve structured building out this business is really by focusing on the fact that regulators in the United States are really focused on the small investor, and so are we. If you’re doing what’s right for the retail investor, you’re doing what’s right for regulators.”

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Tron founder Justin Sun posts public apology over Buffett lunch

Blockstack CEO on Libra: ‘We have already done what Facebook is trying to do’

Jamie Dimon has questions about Facebook’s Libra coin

Facebook's Libra coin aims to 'put the currency back in cryptocurrency'

Cryptocurrency CEO who paid $4.6M for lunch with Buffett: 'It might be unrealistic'

Exclusive: SEC quietly widens its crackdown on ICOs

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.