Crypto price crash actually good for business, say entrepreneurs

Entrepreneurs building cryptographic projects and blockchain technology think the crash in cryptocurrency prices is actually good for business.

“I’m going to repeat something that everyone says in this ecosystem but it’s true: when you’re in crypto winter, people actually are building cool technology as opposed to watching prices on the ticker and I think that’s healthy,” said Arthur Breitman, one of the developers of Tezos, a platform for building decentralised apps.

Breitman’s view was echoed by others across the first day of the Paris Blockchain Week summit on Tuesday, which brought together developers, entrepreneurs, policy makers, and investors.

READ MORE: France pushes to become global hub for blockchain — the tech behind bitcoin

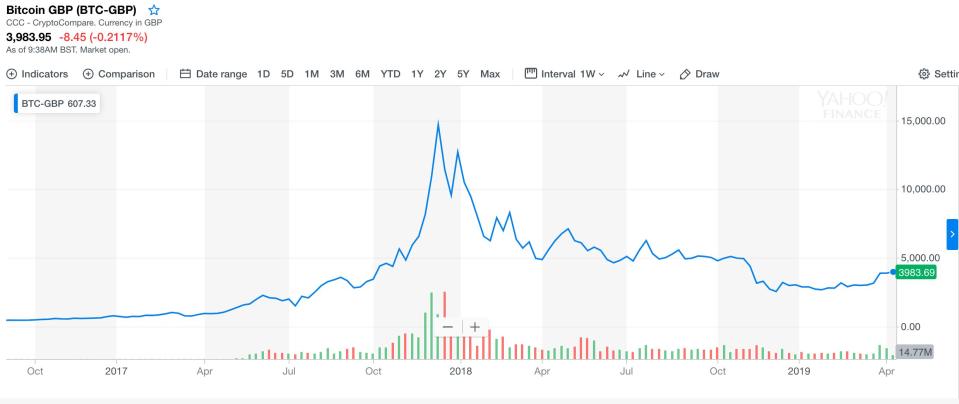

Cryptocurrencies exploded in popularity in 2017, with a proliferation of new coins created to fund projects and surging prices. Bitcoin (BTC-GBP), the biggest and most well-known cryptocurrency, rose over 1,600% against the dollar in 2017.

However, prices crashed dramatically at the start of 2018. The cryptocurrency market shrank from around $828bn in January of that year to $130bn at the start of 2019. Prices and market activity has largely flat-lined this year, although there are some signs of a recent pick up in interest.

Within the crypto industry, the crash in prices and decline in interest has been “the crypto winter.”

Many crypto projects have less to spend on their development as a result of the price crash. The majority of projects funded themselves through so-called “initial coin offerings,” in which newly created crypto tokens were sold in exchange for bitcoin (BTC-GBP) or ethereum (ETH-GBP). The fall in prices of bitcoin, ethereum, and these newly created tokens has depleted war chests.

“You can no longer grow excessively because you really need to make use of the resources you have and make the most of the people you have,” Dominik Schiener, the cofounder of IOTA, told Yahoo Finance UK.

Schiener said that the IOTA Foundation, the non-profit helping to develop the IOTA platform, has seen its resources fall from around $500m to close to $40m largely due to declining prices. (IOTA is applying blockchain technology to the internet-of-things).

However, like Breitman, Schiener thinks the price crash is a good thing.

“If you have a lump sum of money you don’t know what to do with, you don’t think strategically, you just think: what can I do with all this money?,” Schiener said.

READ MORE: Coinbase to launch crypto debit card in the UK: 'We’re very excited about this'

Benedikt Angerer, who works in business development at Austrian cryptocurrency broker BitPanda, said it was “all hands on deck” during the price run up in 2017 but the crypto winter has allowed the company to focus on innovation again.

A tempting comparison is the dotcom bubble. After the bubble burst in the early 2000s, tech stock prices crashed and many companies went out of business. However, promising businesses such as Amazon and Google rode out the crash and, in the years that followed, plenty of new companies emerged based on the same internet technology that had fuelled the mania in the late 1990s.

However, Breitman said: “The space is different from the dotcom bubble in the sense that in the dotcom bubble these are companies and these are businesses, and here this is something very, very different.

“[In crypto] you’re talking about networks and they’re all competing for what I would call a monetary premium. They’re all competing to be money. Even the networks, it’s basically money. And so the dynamics of this are actually quite different.”

Breitman said he believes the space will eventually be dominated by just a few decentralized platforms.

“What you notice in crypto winter is you start to see concentration,” he said.

READ MORE: 'FOMO' and 'get rich quick' dreams drive UK crypto buying, studies find