Financial markets enjoy strongest start to the year in over a decade — but the party could be short lived

Financial markets and investment assets enjoyed one of the strongest first quarters on record in 2019, despite fears of a looming global economic slowdown.

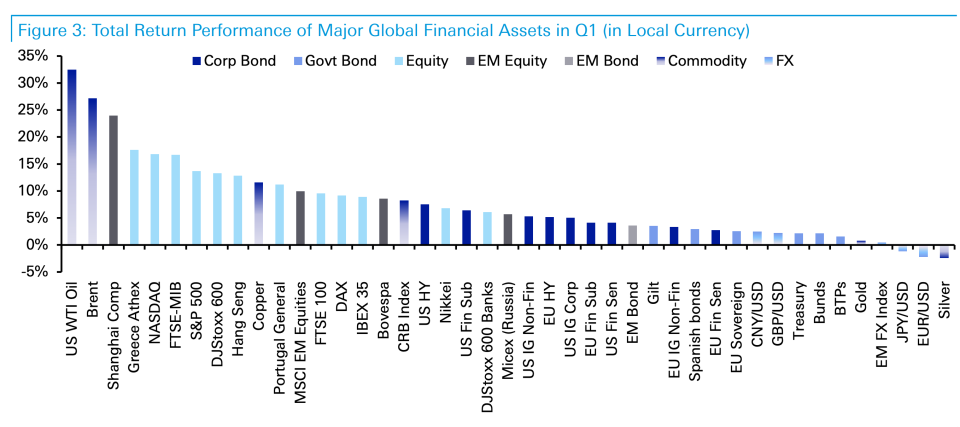

Thirty-seven out of 38 assets tracked by Deutsche Bank finished the first three months of 2019 with positive returns, the bank said in a note on Monday.

The best performing investment was oil (CLK19.NYM), which ended the quarter up 32.4%. Stocks also performed well, with the Shanghai Composite (000001.SS) ending March up by 23.9% since the start of the year. The S&P 500 (^GSPC) was 13.6% better over the same period and the STOXX 300 was up by 13.3%.

“The first quarter of 2019 will undoubtedly go down as one of the most memorable on record in markets given the broadness of positive total returns across assets, especially after 2018,” Deutsche Bank strategists Craig Nicol and Jim Reid wrote in a note to clients on Monday.

“We had 11 assets end Q1 with double digit returns, the most since Q1 2012. So it’s the scale of returns which have also been impressive, as well as the breadth … our data for all 38 assets goes back to 2007 and we’ve never seen a stronger Q1 during this time.”

Separately on Monday, UBS flagged a strong start to the year for hedge funds.

“In 2018, hedge funds posted -4.8%, but returns were highly dispersed between strategies

and fund sizes,” UBS Wealth Management strategists Karim Cherif and Georg Weidlich wrote in a note to clients. “Most styles recouped their losses in 2019 and overall hedge funds are up 4.9% YTD through

February.”

The buoyant start to the year comes after a tough 12 months for investors in 2018 that saw a number of assets post their worst ever annual returns.

However, the strong performance may be short-lived given growing fears of a global economic slowdown. A raft of central banks have cut their growth forecasts for the upcoming year amid a worsening global growth outlook.

IMF managing director Christine Lagarde said in January that the “risks are rising” as the lender cut its global growth forecast for 2019. The European Central Bank also cut its growth forecast for the year at the start of March after a slew of poor data. The ECB announced a new package of financial support designed to kickstart growth.

Meanwhile, the US yield curve inverted for the first time since 2007 just over a week ago. That means investors were demanding higher returns for holding short-term US government debt compared to longer-term notes, an unusual state of affairs. An inversion of the yield curve is seen by many investors of a sign that a recession is imminent.

“The multi-billion dollar question now is how far can this momentum run into Q2 and beyond,” Deutsche Bank’s Nicol and Reid wrote.

Morgan Stanley said in a note on Monday that it nows sees a 70% chance of the US stock market hitting a downturn within the next 12 months. Any slowdown in the US would most likely spill over into global markets.

“We now estimate that there is a ~70% likelihood that this will shift to downturn over the next 12 months,” a team of analysts led by Serena Tang wrote in a cross-asset strategy note. “Such turns do not necessarily mean recession, but do correspond to materially worse return environments for credit and equities.”

Morgan Stanley told its clients to shift their investments from US stocks to “rest of the world” stocks in preparation for any potential slump.

Investors are already making moves to prepare for a possible downturn. “Flight to safety accelerated in March with bonds & cash seeing further inflows while equity market internals turned defensive,” analysts at Barclays told clients on Monday

Bonds and cash are seen as less risky investments during times of bear markets, while equities tend to be popular in bull markets.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

CBI: Labour’s re-nationalisation plans will cost £175bn and ‘do profound harm’ to pensioners

Hot fintech Ebury burns £19m on expansion as it eyes new investment

Debenhams shares jump 80% as Mike Ashley’s Sports Direct weighs £61m bid

‘Deep frustration and anger’ as business leaders tell MPs to compromise on Brexit

Apple’s new Goldman Sachs credit card could be part of deeper push into finance

Yahoo Finance

Yahoo Finance