5 traits you need to operate a strong multi-state weed business: analyst

fThe global cannabis industry is on pace for powerful growth over the next several years – but not all cannabis companies are equipped to capitalize on the projected upside.

Legal cannabis spending is set to grow at a 26% compounded annual growth rate over the next four years, hitting $32 billion in 2022, according to a report from BDS Analytics, a market research firm for the cannabis industry. Spending is anticipated to hit about $17 billion this year, an increase of 39% from 2018, BDS Analytics estimates.

“I can’t think of a meaningful-sized industry in which one has the confidence about that sort of growth rate,” Roy Bingham, CEO of BDS Analytics, said at the National Cannabis Industry Association’s CannaVest conference in Boston Tuesday. “In fact, I can’t really remember one except when we go back to the early days of the internet, for example.”

To be sure, the legal industry still faces a considerable number of regulatory hurdles within the U.S., largely as a result of its categorization as a Schedule 1 narcotic at the federal level under the Controlled Substances Act.

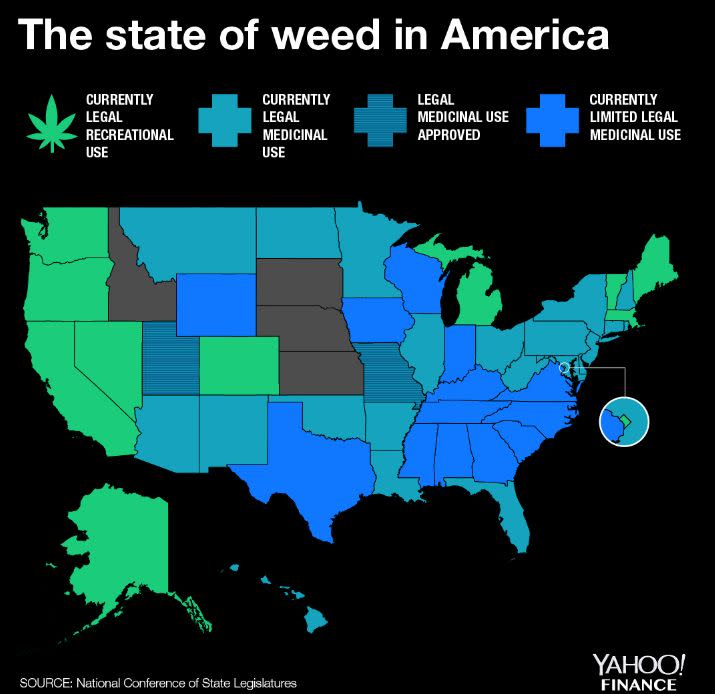

But most analysts believe federal legalization is, at this point, a matter of “when” rather than “if.” Currently, 10 U.S. states and the district of Columbia have adopted laws allowing for recreational adult use. According to BDS Analytics, most future spending in the cannabis industry will take place in the U.S., which already dominates as the world’s largest market. BDS Analytics data suggests that $22 billion of the $32 billion projected in legal cannabis spending in 2022 will be in the U.S. market.

But just because a company is in cannabis doesn’t mean it is well-positioned to capitalize on this explosive growth.

There are a handful of key attributes multistate operators (MSOs) within the U.S. need in order to achieve success, Paul Penney, managing director for Northland Securities, said during a panel at CannaVest.

Financial discipline

“In terms of where we see success coming from these MSOs, I think there’s pretty much five categories to what we look for,” said Penney, whose coverage area includes U.S. companies MedMen, iAnthus Capital Holdings, Planet 13 and KushCo. “Number one is financial discipline, in terms of allocating capital smartly, especially today in terms of, it is a heavy M&A environment, so buying at the right price, not paying a high multiple for M&A.”

Mergers and acquisitions between cannabis companies have dominated the space, particularly as a means of extending business operations across state boundaries, where regulation may not be completely symmetrical. Since their products can’t be transported across state lines, companies that want to grow to other states must partner with or acquire a firm in another state. MedMen, a Culver City, California-based cannabis company, for instance, acquired Treadwell Simpson Partners and its affiliates last summer for $53 million, giving MedMen access to Treadwell’s cultivation facilities and dispensaries by way of its Florida cannabis licenses.

“This consolidation, this aggregation, this M&A is within the industry,” Scott Greiper, president of Viridian Capital Advisors, said during a panel at CannaVest. “It’s true consolidation, companies buying other companies for positioning.”

Operational prowess and credibility

Success in the cannabis space – as with any company – starts at the top, Penney said.

“Number two, in terms of operational prowess at the corporate level, in terms of having strong leadership that has success-based goals in mind, and at the regional level, a lot of these MSOs are opening tons of stores,” Penney said. “Having the right process in mind in terms of doing this efficiently, and then three would be credibility in terms of having a pathway to be profitable…[and] a really tight corporate governance.”

Steven Kaplan, managing director of investment bank Ladenburg Thalmann, said at CannaVest that strong governance especially is important for securing checks from institutional investors, who have the capacity to deploy much larger sums of capital as companies scale up.

“What institutional capital cares about is not only your business plan, but your governance. Do you have a board? Do you have checks and balances, a real CFO?” Kaplan said. “The things you do early on as you're developing are going to be things are going to put you in a position to be able to get to the next level on track institutional capital.”

Branding

Branding will be central to cannabis companies’ long-term strategy, Penney asserted.

“Branding is just starting with the tip of the iceberg in terms of having brands emerge on the regional level,” Penney said. “But who’s going to be the next Budweiser, who’s going to be the next Coors of the cannabis space? We don’t know yet.”

U.S. federal regulatory constraints have locked cannabis companies out of a host of some of the largest marketing opportunities, making branding a particular challenge, Penney noted.

“You are limited in terms of how you market cannabis. You can’t have a Super Bowl ad,” Penney said.

CBS this year rejected a proposed Super Bowl advertisement from U.S.-based medical cannabis company Acreage Holdings, telling Vox that it does “not currently accept cannabis-related advertising.” Cannabis companies have also faced scant opportunities to advertise on digital platforms including Google Ads.

Despite the hurdles, finding ways to develop brand recognition and loyalty will nevertheless be crucial for long-term differentiation among cannabis companies, and for growing margins as average selling prices of cannabis flower declines.

“In any consumer products industry, the value is in the brand,” Greiper said. “The sustainable value is in the brand, and we’re starting to see investors recognize that.”

Supply constraints

Lastly, Penney said that successful multi-state operators must be cognizant of where they choose to do business, and should choose “supply constrained markets in terms of being in markets where there’s a rational number of licenses that are granted.”

Looking for markets with a high-density population and high-income levels will also set companies up for success, Penney noted.

And that will become especially important as BDS Analytics’ Bingham said the average cannabis consumers becomes more oriented toward wanting and being able to afford premium and luxury goods.

Case in point – the New York Times reported earlier this week that department store chain Barneys has plans to open a luxury line of pot paraphernalia, including rolling papers made from organic French hemp and a sterling silver pot grinder ticketed at $1,475 each.

While not every cannabis-related product will be able to demand such a price tag, it’s a testament to the burgeoning blend of goods and price points available in the space. And that demand for a such a product mix will only continue to grow, many analysts contend.

“They’re an affluent consumer,” Bingham said of cannabis’s current and future consumers. He added that the average age of legal cannabis consumers has grown over the past several years to now stand at 40 years old.

“They are everyday consumers, they’re the people that are targeted by luxury and premium brands,” Bingham said. “They are outdoorsy, they’re outgoing, they’re very social. They are a diverse population of people who are in many ways protagonists for the industry as well.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

What Wall Street strategists forecast for the S&P 500 in 2019

Beer sales are lukewarm and pot could be part of the problem

Consumer sentiment plunges to its lowest level since Trump’s election