Why Dividend Investing Works for All Ages

Dividend investing is often discussed as an income strategy for retirees, but its potential to boost returns for investors across a wide variety of holding periods and investment styles is sorely overlooked. Plus, this particular investment strategy can be critical to your efforts to build wealth in the stock market.

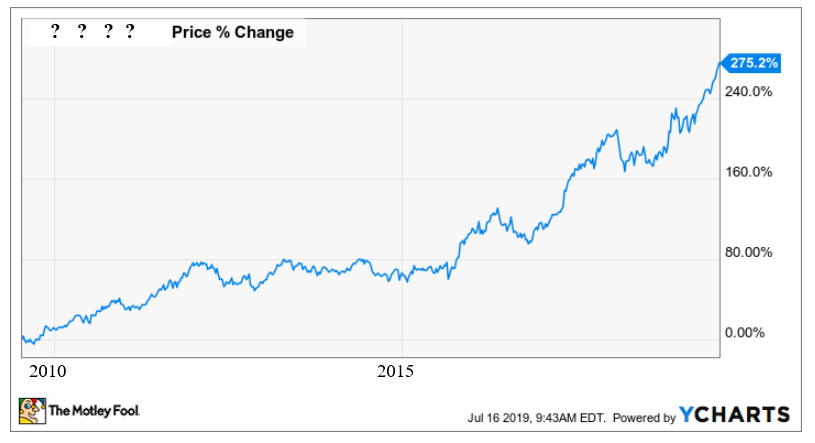

Below is a stock chart of a company you probably have heard of, showing its share price performance from the last 10 years.

It's obvious that this stock has performed quite well, averaging a 27% return annually over the past decade -- meaning that an investor would have more than tripled their money by holding this stock during the period. We'll get back to this company, and the lesson it holds about dividend investing, a little later.

Image source: Ycharts. Annotations by author.

Advantages of dividend investing: A case study

It's important to note that dividends are discretionary; a company's board of directors has no legal obligation to provide a recurring cash distribution to shareholders. However, in practice, companies that decide to issue a regular dividend often also commit to increasing the distribution whenever feasible.

A large proportion of consistent dividend payers bump up their payouts to shareholders annually. Those increases expand the amount of dividend yield an investor receives over time on the original cost basis of a stock. Mastercard (NYSE: MA) is a great example of the phenomenon of rising "yield on cost."

The card issuance and payments technology titan has raised its dividend payout by an average of 25% each year over the past five years. Mastercard's expansion in the European market, double-digit growth in cross-border payments, platform innovations, and strategic acquisitions have amplified its cash flow to enable the increases.

If an investor purchased Mastercard shares in 2014, they would have enjoyed an initial yield of roughly 0.5% on the company's $0.44 annual payout per share. The organization has since tripled its quarterly dividend -- it now totals $1.32 per share annually. If the dividends were reinvested, the same investor would now take home a 1.8% annual yield on their original cost basis in the stock.

Mastercard should open our eyes to the fallacy that dividend stocks are stodgy -- they don't have to be. Despite a market capitalization of nearly $285 billion, Mastercard has behaved like the headiest of growth stocks since its 2006 initial public offering, having generated an astounding 1,750% total return in 13 years.

The company's current dividend only yields 0.44% due to tremendous growth in share price. So, while a patient investor can turn the dividend into an income vehicle over time due to steady payout hikes, many shareholders will reinvest the dividend simply because it represents a sort of bonus: equity shares in a fast-growing company without any additional out-of-pocket investment required.

Image source: Getty Images.

Calm in the storm

The power of a growing yield and reinvesting dividends is also enhanced by an investor's ability to use dividend stocks as a hedge against market volatility. Dividend-paying stocks, even those with high growth potential, are often less volatile than their nonpaying counterparts.

This is due in part to a valuation metric called the dividend discount model (DDM). Conceptually, this model prices a stock at the sum of future dividend cash flows discounted back to their present value. In more everyday terms, it presents a way to value what a company is worth in terms of cold, hard cash returned to shareholders.

While institutional investors are more likely to use DDM to price a stock, it's important for everyday investors to understand that the model provides an alternate basis for gauging a stock's value that supplements traditional techniques, such as pricing models that are based on future earnings. This contributes to the relative stability of dividend-paying stocks as they trade on the open market.

In many cases, companies that promise rising annual dividends to shareholders naturally focus on keeping cash flow predictable, and exert discipline over earnings to meet annual, quarterly, and -- in some cases -- monthly payout goals.

While today's markets may be coasting at all-time highs, the share price gains are taking place amid a backdrop of trade disputes, geopolitical uncertainties, and the World Bank's recent downgrade of expected 2019 global GDP growth. Now may be an opportune time to look into adding some relatively stable dividend payers to your portfolio, before volatility potentially rises in the coming quarters.

Economic transformation is boosting traditional dividend stocks

As the U.S. continues to evolve from a manufacturing economy to a service economy, dividend payers undergoing technological transformation are creating opportunities for above-average returns.

Take Intuit (NASDAQ: INTU), which, like Mastercard, is a large-capitalization, dominant industry player that acts more like a growth stock than a phlegmatic stalwart. Intuit has transitioned from being a provider of desktop accounting and tax modules to a cloud-based behemoth over the past several years. By rolling out subscription-based models for its popular QuickBooks Online accounting software, the company has averaged annual revenue growth of 13% in its last two fiscal years.

At the time of this writing, both Mastercard and Intuit have generated a total return of 268% each for their shareholders over the last five years -- nearly quadrupling initial investments when we account for reinvested dividends. And Intuit's dividend yield, though just 0.7%, allows investors to pick up more shares of the tech powerhouse every quarter.

Are you looking for an industrial stock to anchor tech-based stock dividend candidates in your brokerage account?

As the U.S. economy continues in its yearslong stretch of moderate growth since the Great Recession, railroad giant CSX (NASDAQ: CSX) has capitalized on opportunities by taking on more premium intermodal shipments and by significantly improving its operational efficiency. The company's stock has quietly gained an impressive 180% over the last three years -- 193% after factoring in reinvested dividends. CSX shares yield roughly 1.2%, about half of what they did three years ago due to their rapid stock price appreciation.

A visual example of the impact of dividends, and a final caveat

Let's return briefly to the chart from beginning of this article. Did you figure out the mystery company?

McDonald's (NYSE: MCD) needs little introduction, but many investors might not be aware that the fast-food giant's ascent over the last 10 years has been so linear, or that dividends have had such a tangible impact on its returns. The chart from the beginning of the article simply shows price performance, which is shown below in blue. Let's layer in the company's total return over that same period, shown on the chart in orange.

McDonald's has tripled its shareholders' money over the past 10 years, but with dividends reinvested, the result is a quintupling of funds -- $1,000 invested in July of 2009 would be worth over $5,000 today. A generous, recurring distribution to shareholders makes many consumer stalwarts names look like tech stocks over an extended time horizon.

Dividends can be utilized for sustained growth that benefits investors of all ages -- the younger the investor, and the longer the holding period, the better. Do remember this caveat, however: No strategy is foolproof. Always do your homework before clicking "buy." The virtue of a regular dividend is a signal, not a guarantee, that a company has sound prospects for sustained success.

More From The Motley Fool

Asit Sharma has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Intuit and Mastercard. The Motley Fool has a disclosure policy.