The subtle tone shift from Warren Buffett every investor must note: Morning Brief

Monday, May 4, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Stocks only for the long run

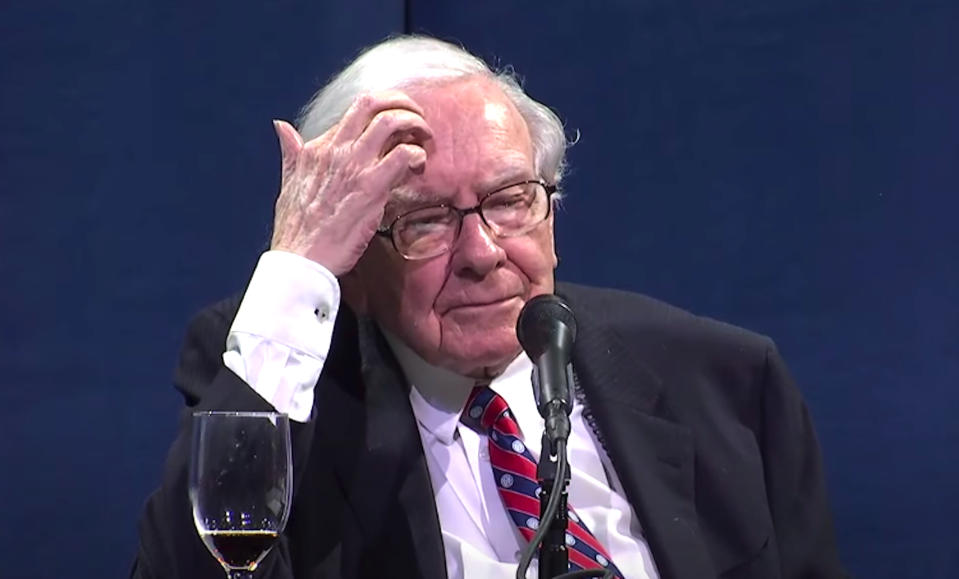

Warren Buffett sounds cautious.

At the Berkshire Hathaway (BRK-A, BRK-B) annual shareholders meeting on Saturday, Buffett began the proceedings by offering a roughly 75-minute overview of why American history offers reasons for investor optimism.

This is a familiar theme for Buffett. In the last several years he has written and spoken extensively about the “American tailwind” that investors can ride by investing in the stock market. And while Buffett reiterated this long-term optimism on Saturday, there was a subtle change in his message.

And investors should take note.

“I don’t know, and perhaps with a bias, I don’t believe anybody knows what the market is going to do tomorrow, next week, next month, next year,” Buffett said Saturday. “You can bet on America but you have to be careful about how you bet. Simply because markets can do anything... Nobody knows what’s going to happen tomorrow.”

On the surface, these comments appear benign. “Warren Buffett says investors should think long-term” isn’t much of a headline.

But Buffett’s outline isn’t that investors should think long-term right now, but that they must think long-term. In other words, there aren’t many reasons Buffett can find to see the current situation as anything but challenging. And considering Buffett’s long held bullish views, this is as bearish a take as we’re liable to ever hear from Buffett.

And Buffett’s recent actions speak louder than any of the words uttered during Saturday’s meeting.

The biggest headline was Buffett’s confirmation that Berkshire sold its entire stake in the country’s four largest airlines — American (AAL), United (UAL), Delta (DAL) and Southwest (LUV). As Buffett outlined on Saturday, in his view the bet was simple: pay about $8 billion for these holdings to get back about $1 billion earnings.

The coronavirus pandemic and associated global economic shutdown changed this picture considerably. Buffett went so far as to tell the airlines: “I wish them luck.”

Berkshire was also restrained in repurchasing its own stock during the quarter, spending just $1.6 billion buying back its own shares and conducting no repurchases after Mach 10. Morningstar analyst Gregg Warren said he was “extremely disappointed” with this decision.

“While we can certainly understand the need to be cautious with investments and acquisitions in the near term...the company has a good investment opportunity in its own common stock and management should really be called out for failing to take more aggressive action during the first quarter,” Warren added.

In response to a question about this decision on Saturday, Buffett said, “I don’t think Berkshire shares are, at present value, at a significantly different discount than they were when we were paying somewhat higher prices.”

Buffett added that, “We always think about [repurchasing stock], but I don’t feel that it’s far more compelling to buy Berkshire shares now than I would’ve felt three months, or six months ago, or nine months ago. It’s always a possibility. And we’ll see what happens.”

And with that, Buffett more than says it all about his current view of Berkshire’s stock and the market more broadly.

Berkshire shares were down 19% this year through Friday’s close. Over the last year, the stock is down 15%. At any time in the last three, or six, or nine months Buffett would’ve been paying a significantly higher per-share price to repurchase stock.

And yet even with the market’s current discount he doesn’t think the stock is undervalued. And suggests he doesn’t think much else is, either.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Earnings

Tyson Foods (TSN) before market open; Del Taco (TACO), Shake Shack (SHAK), Skyworks (SWKS) after market close

Top News

Stocks fall on 'risk of cold war' between US and China over coronavirus [Yahoo Finance UK]

EU factories' record slump sparks highest lay-offs since 2009 [Yahoo Finance UK]

J. Crew files for bankruptcy protection [Reuters]

Berkshire Hathaway Highlights

Buffett: Berkshire has dumped all of its airline stocks, says 'world has changed'

Berkshire Hathaway Earnings: Operating profits increased, but investments got slammed

Buffett: The American economic miracle 'has always prevailed and it will do so again'

Buffett: I don't know what's next for stocks, and I don't think anyone knows

Buffett still cites See's Candies as an acquisition he loves, 48 years after buying it

Buffett on not deploying massive cash pile: 'We don’t see anything that attractive to do'

Buffett rejects diversity measure, but throws support behind its goal

Buffett: Demand for office and retail space may drop 'fairly significantly'

Buffett says stock buybacks aren't 'immoral,' but some are 'stupid'

Berkshire's shareholder shopping event has been canceled: Here's how to buy Buffett merchandise

YAHOO FINANCE HIGHLIGHTS

Reopening states will cause 233,000 more people to die from coronavirus, according to Wharton model

Starbucks CEO: We'll use tech, and trust, to lure back customers after coronavirus lockdowns

The University of Illinois made a prophetic insurance bet in 2017

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay