Federal agencies kill big banks’ hopes of escaping Volcker rule

Five regulatory agencies have tightened the standards for exemption from a key post-crisis regulation known as the Volcker rule, ending larger banks’ hopes that they may have been able to escape compliance originally meant for “community” banks.

Despite comments from trade groups and lawmakers that large banks should get a break from the regulation, the agencies said Tuesday that they were “not persuaded” by the argument that double negatives in the law extended to banks as large as U.S. Bancorp (USB) and PNC Financial Services (PNC).

The Volcker rule prohibits banks from short-term proprietary trading of securities, derivatives, and commodities, and was enacted into law as part of the Dodd-Frank financial regulatory framework in 2010.

Last year, a new law ordered federal regulators to relieve community banks of the rule if they had under $10 billion in total assets and less than 5% of their assets in trading assets and liabilities.

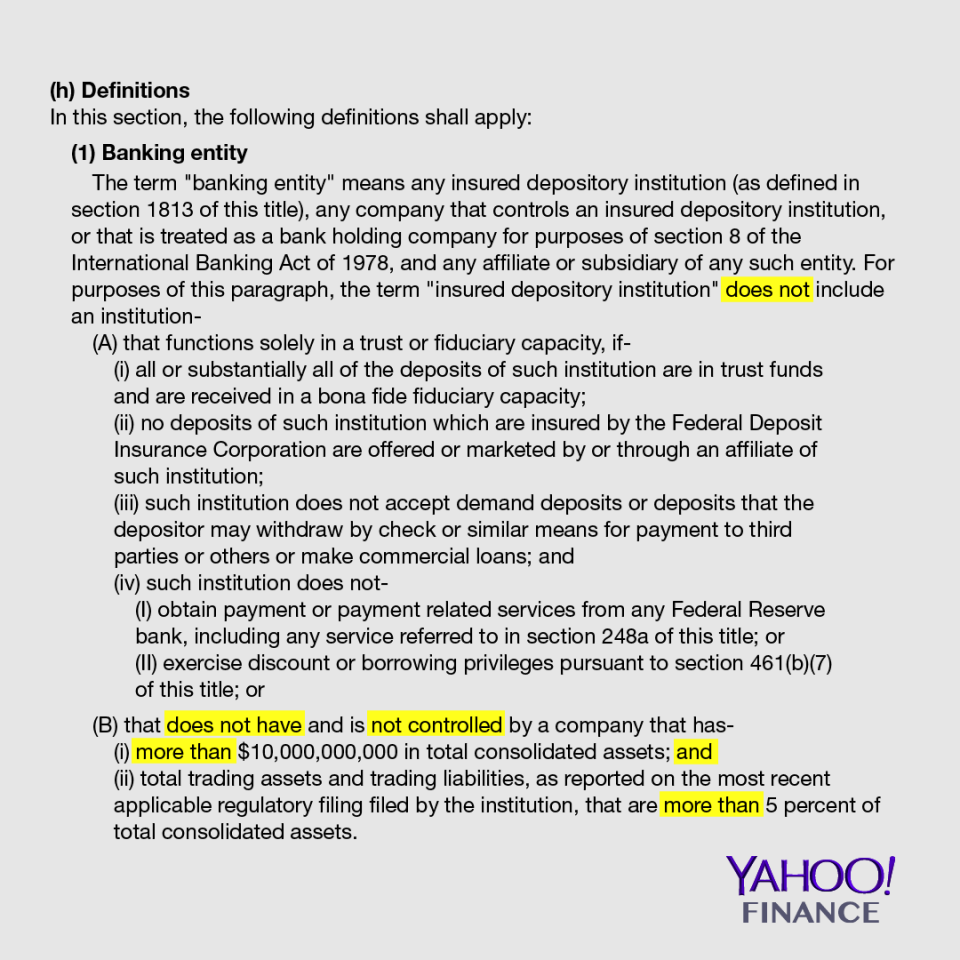

But in December, Yahoo Finance reported that some double negatives in that law may have left the door open for an alternative interpretation that would also extend that relief to banks well above $10 billion as long as they had relatively small holdings of trading assets and liabilities.

The final rule from the five government agencies with jurisdiction over the Volcker rule — the Federal Reserve, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Commodity Futures Trading Commission, and the Securities and Exchange Commission — likely puts an end to the debate and codifies the interpretation that no banks above $10 billion will get the exemption.

Although the large banks could launch a lawsuit against the regulatory agencies challenging this interpretation, it is unclear if any banks would be willing to mount such an effort.

‘And’ or ‘Or’

In the spring of 2018, a number of moderate Senate Democrats approached the Republican majority with a proposal to pare back portions of Dodd-Frank, with a priority on reducing regulatory requirements on smaller banks. The lawmakers argued that some post-crisis regulations, like the Volcker rule, were too burdensome for community banks to comply with.

President Donald Trump signed the bill in May 2018.

A summary of the bill at the time promised “community bank relief” to banking entities that have “(1) less than $10 billion in total consolidated assets, and (2) total trading assets and trading liabilities that are not more than five percent of total consolidated assets.”

As Yahoo Finance reported, former Trump regulator Keith Noreika (now a bank attorney at Simpson Thacher) advised some large banks on an alternative interpretation that would only require a firm to meet one of those criteria to get the exemption.

The rationale: the legislative text outlining the exemption included some double negatives that could be read as flipping the “and” between those two criteria, to an “or.”

Under the “or” interpretation, a bank well above $10 billion could get an exemption as long as it has a trading portfolio smaller than 5% of its total assets.

Mint chocolate chip

After Yahoo Finance published its story, federal regulators received comments from groups and politicians inside the D.C. beltway arguing that the “or” interpretation was correct.

The Competitive Enterprise Institute, a libertarian think tank in Washington, wrote to the five regulators in March and used an ice cream analogy to illustrate its point.

“Imagine that ice cream products, in general, have been an extensively regulated category, but then a new statute narrows that category to consist of only mint chocolate ice cream,” CEI wrote. “Clearly, to fall into that new category, an ice cream must be both mint and chocolate. If an ice cream is not mint, or if it is not chocolate, then it is excluded from regulation under the statute’s new, narrower definition.”

House Republican Blaine Luetkemeyer of Missouri also submitted a letter, telling the regulators weeks after the Yahoo Finance story that the intent was, in fact, for large banks to get an exemption as long as they have “relatively immaterial trading activities.”

Luetkemeyer was not an original drafter of the bill, and the Senate’s bill summary appeared to make it clear that “community banks” needed to meet both criteria.

The regulators on Tuesday sided with the “and” interpretation.

“After considering these comments, the agencies are not persuaded by the argument that the exclusion under section 203 of EGRRCPA extends to institutions with total consolidated assets in excess of $10 billion,” they wrote in the final rule published Tuesday. “The agencies believe that the statute requires an institution to satisfy both criteria to qualify for the exclusion. This approach is most consistent with the statutory language of EGRRCPA, the congressional intent behind the statute, and the structure of the statute as a whole.”

Luetkemeyer’s office declined a request to respond at time of publication.

Banks could mount a challenge through the courts, but a resolution would likely take massive legal resources and time. Additionally, a test known as the “Chevron deference” has established a legal precedent for the courts to defer to an agency’s legal interpretation of a statute that may be vague.

In other words, the Chevron deference would favor the regulators over the banks unless the bank can prove that the statute clearly exempts banks with more than $10 billion in total assets.

Noreika did not respond to requests for comment.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Powell may push back on the possibility of rate cuts in testimony this week

Jobs report takes steam out of expectations for 50 basis point Fed cut

In third effort to fill the Fed, Trump nominates 'conventional' candidate

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.