Volcker recession-like coronavirus impact could set up 'multi-million' job gains: Goldman

Goldman Sachs still sees a case for a V-shaped recovery amid the novel coronavirus, making the argument that the 1981-1982 recession could be a model for “multi-million job gains” once the labor market rebounds.

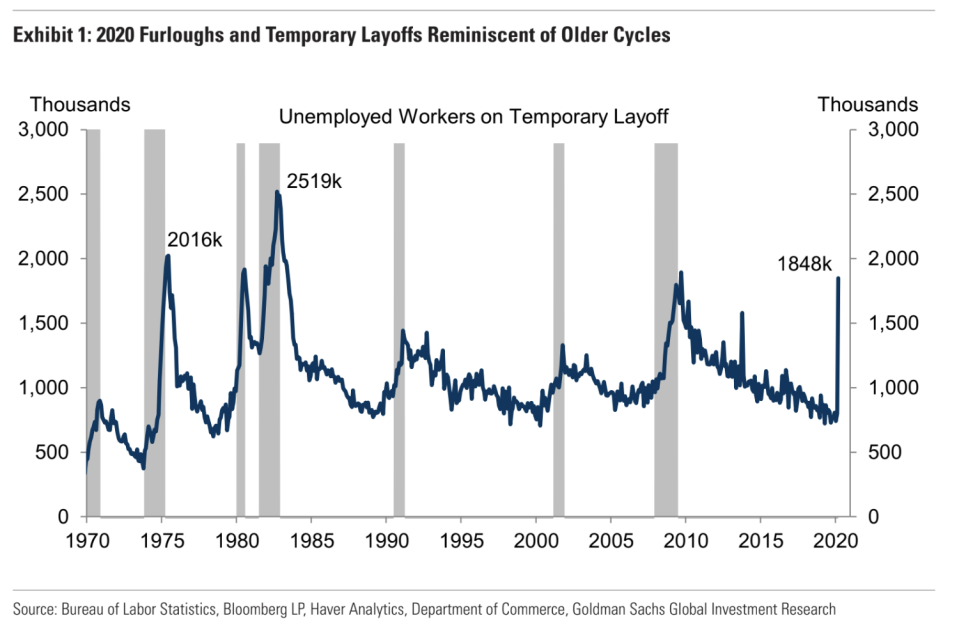

The investment bank’s research team wrote Wednesday that the “silver lining” of the surge in temporary layoffs is exactly that — the job loss is temporary. The Goldman analysts said they “take some comfort” in parallels to the 1981 recession triggered by former Federal Reserve Chairman Paul Volcker’s aggressive interest rate hikes to battle inflation.

“Short-term layoffs were an important ingredient in the subsequent V-shaped recovery, as many of the record-high 2.5 million temporarily separated workers were rehired once financial conditions eased,” Goldman wrote.

To tackle prices inflating to the tune of nearly 10%, Volcker ratcheted interest rates to as high as almost 18% in April of 1980. The economy reeled from sky-high borrowing costs until inflation was under control, after which the Fed began lowering rates to restore business activity.

Between 1983 and 1984, non-farm payroll growth averaged 362,000 a month, which was the fastest early-cycle recovery since World War II.

Goldman wrote that the current shutdown of the labor market is similar to the Volcker recession in the sense that both were “man-made.”

“Responding to the 1970s stagflation, the Fed deliberately reduced economic activity for over a year in order to slow inflation and anchor inflation expectations, much like today’s economic policymakers are discouraging some economic activities in pursuit of a public health priority,” Goldman wrote.

The analysts pointed out that the same types of industries affected today were also affected in the Volcker shock, namely manufacturing and retail.

If the labor market can reboot itself quickly, Goldman predicts “several quarter of multi-million” job gains (not annualized) and brighter prospects for rebounding GDP.

However, the mechanics of the present-day coronavirus-induced recession are noticeably different. Goldman noted that for one, the U.S. economy is at risk of a substantially deeper and faster loss with about 15 million jobs at risk just this quarter.

The worse-than-expected jobs report for the month of March showed the U.S. economy losing 701,000 jobs, and that reflected a period before the majority of the U.S. went on lockdown to contain the coronavirus. Jobless claims over the two-week period covering the end of March showed almost 10 million Americans turning to unemployment insurance as they lost their jobs.

Goldman added that its forecast faces a high degree of risk because of possible financial spillovers and the possibility that the recovery could be derailed by a resurgence in cases of COVID-19, the disease caused by the new coronavirus.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Coronavirus could wipe out nearly a fifth of small businesses: NY Fed surveyBanks undergoing 'real stress test' as recession fears continue

Federal Reserve to backstop Paycheck Protection Program loans

‘Substantial deterioration’ in consumer expectations: NY Fed survey

SF Fed Chief: Central bank will ‘do whatever it takes’ to support economy

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.