Dr. Reddy's (RDY) to Report Q4 Earnings: What's in Store?

Dr. Reddy’s Laboratories Ltd. RDY is scheduled to report fourth-quarter fiscal 2019 results, before the market opens, on May 17.

The company’s shares have increased 6.1% year to date compared with the industry’s growth of 2.0%.

Let’s see how things are shaping up for this announcement.

Factors in Play

Dr. Reddy’s North American generics unit is witnessing pricing pressures since the last few quarters, due to enhanced channel consolidation and increased competitive pressure on sales of some of the key generic products. We do not expect to see any improvement in this negative trend in the upcoming quarterly results.

The U.S. generics industry is facing significant competitive and pricing pressures. The ongoing consolidation of customers in the industry has led to increasing price erosion and decreasing volumes. The consolidation in the industry has increased the ability to negotiate lower prices for generic drugs. A sharp decline in generic drug prices is proving to be a major challenge for generic drug makers and distributors.

However, generics sales should continue to improve in the Emerging Markets and India units. Moreover, revenues are expected to continue to rise in the Pharmaceutical Services & Active Ingredients (“PSAI”) segment. Sales declined in the Proprietary Products and Others segments in the fiscal third quarter and it remains to be seen if the metric improves in the to-be-reported quarter.

As of Dec 31, 2018, Dr. Reddy’s had 103 generic filings (100 abbreviated New Drug Applications [ANDAs] and three new drug applications) that are pending FDA approval. Of these ANDAs, 59 were Para IV filings and 33 have first-to-file status. We expect to get more updates on the company’s NDA filings during the fourth-quarter conference call.

Dr. Reddy’s currently carries a Zacks Rank #3 (Hold).

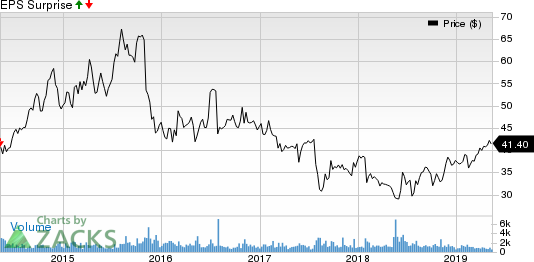

Dr. Reddy's Laboratories Ltd Price and EPS Surprise

Dr. Reddy's Laboratories Ltd price-eps-surprise | Dr. Reddy's Laboratories Ltd Quote

Stocks That Warrant a Look

Here are some stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter. According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 or #5 (Sell-rated) stocks are best avoided.

CannTrust Holdings Inc. CTST is scheduled to release results on May 14. The company has an Earnings ESP of +6.25% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

LogicBio Therapeutics, Inc. LOGC has an Earnings ESP of +25.84% and a Zacks Rank #3.

Biogen, Inc. BIIB has an Earnings ESP of +0.15% and a Zacks Rank #2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

LogicBio Therapeutics, Inc. (LOGC) : Free Stock Analysis Report

CannTrust Holdings Inc. (CTST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research