Going long the 2018 hurricane season with Generac (GNRC)

Hurricane season officially begins on June 1 and runs through November. If this year is anything like last year, there is likely to be a lot of damage. Prior to the official start of the season this week, named storm Alberto brought nervousness to residents of states typically affected by powerful Atlantic storms.

Beyond the physical damage to homes and businesses, one of the biggest inconveniences of a powerful storm is electrical outages. This brief article will look at a stock with a solid technicals and fundamentals and which appears to have excellent upside potential from here.

Last year, Hurricane Irma knocked out power to 64% of Florida’s residents and, incomprehensibly, over 95% of Puerto Rico.

The National Oceanic and Atmospheric Administration (NOAA) is “forecasting a 75% chance that the 2018 Atlantic hurricane season will be near or above normal.” See full forecast.

If I lived in the path of these powerful storms, I would be proactive about making sure the inconveniences of any major storm had minimal impact on my life. I would have storm shutters in place, a plan for food, water and medicine, etc. I would also have a strong generator to make sure I could maintain power for my home.

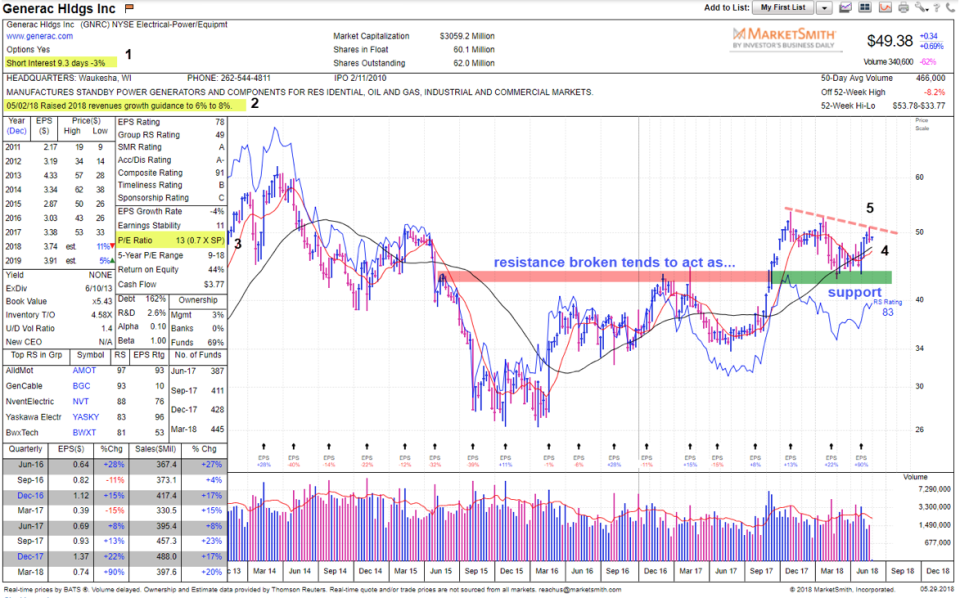

One company which seems to rally each time there are large storms is Generac (GNRC), a “manufacturer of standby power generators and components for residential, oil and gas, industrial and commercial markets.” As the chart below shows, it is not just a hurricane play, but a solid business.

The charts below that annotate the technical and fundamental conditions of the stock.

The chart above is constructed of weekly data in which each bar represents one week of trading. The chart shows the all-time high was reached in 2014 at a price of $62. On Tuesday, the stock closed at $49.38.

There are some positive fundamental and technical factors which should be noted.

1. Short Interest (which represents future buying) is 9.3 days. This means that it would take 9.3 days of the average daily volume (currently 466K/day) for shorts to cover their position. If short sellers become motivated to cover their position, it could have a dramatic effect on the price of the stock.

2. On May 2 of this year, the company raised their revenue growth guidance by 6% to 8%.

3. The current PE ratio is 13, which is undervalued at a rate of 0.7x the PE of the average S&P 500 (^GSPC) stock.

4. The stock is above both the 10- and 40-week moving averages, which indicates buyers are in control of the longer-term trends.

5. The downward trendline will need to be overcome before near-term momentum will have a chance to resume.

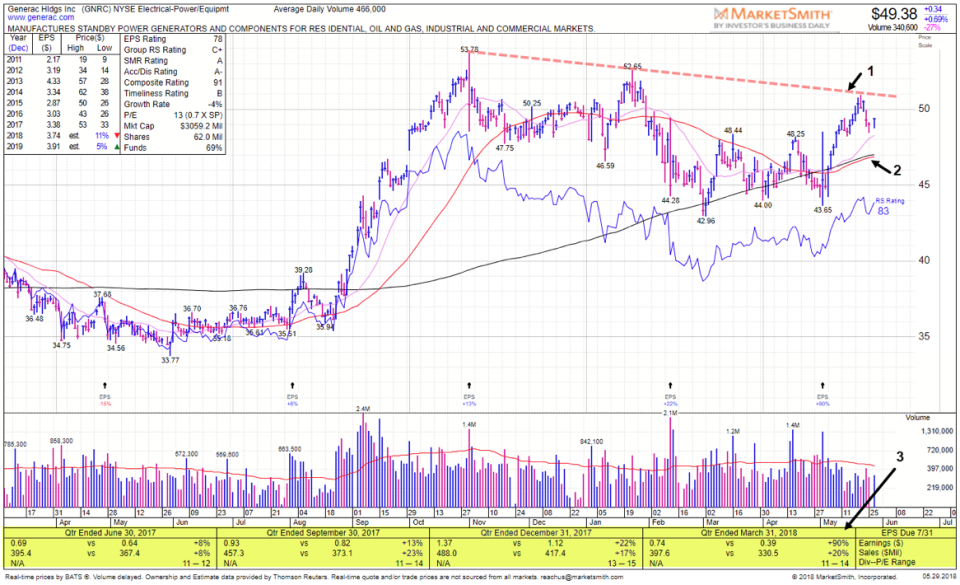

The chart below shows a little over one year of trading in GNRC with each bar representing one day.

The daily chart above shows a more detailed look at not only the price action but also some key fundamental data. Some of the items to note on this chart include:

1. The trendline, which has held prices back since October of 2017, is more visible on this timeframe. It will take a break of the May high for buyers to overcome this obstacle.

2. The support from Q4 acted as resistance from February thru April of this year, and it now looks like it is back to an area of support.

3. The stock is above the rising 50 and 200 day moving averages, which shows agreement amongst intermediate- and longer-term participants. A worst case stop loss should be placed somewhere below these averages which are currently at about $47.00.

4. Each of the last 4 quarters has seen both revenues and earnings increase.

If you invest in growth stocks, then shares of GNRC might have a place in your portfolio. As always, risk management is job number one and you should only participate in the stock if it makes sense to you and parameters should be adjusted to your timeframe.

Read more from Brian Shannon

Gold is saying: Get ready for upside!

Veteran trader shares 11 market truths for stock investors

3 lessons from Bill Ackman’s $4B trading loss in Valeant

Biotech stocks are turning bullish—here’s how to profit