Union Pacific (UNP) Up 1% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for Union Pacific Corporation UNP. Shares have added about 1% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to its next earnings release, or is UNP due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Fourth Quarter Earnings

The company’s earnings of $1.53 per share (excluding $7.72 from non-recurring items) fell short of the Zacks Consensus Estimate by a penny. However, revenues of $5,450 million surpassed the Zacks Consensus Estimate of $5,409.3 million. Earnings per share and revenues expanded 10.1% and 5.5% respectively year over year.

Freight revenues increased 5%, thereby boosting the top line. The uptick was owing to volume growth, increased fuel surcharge revenues among other factors.

Operating income (on a reported basis) in the fourth quarter rose 15% year over year to $2, 251 million. Adjusted operating ratio (defined as operating expenses as a percentage of revenues) came in at 62.6%, reflecting an increase of 0.6 points. Fuel prices increased substantially in the final quarter of 2017. During the quarter, the company bought back 9.2 million shares for $1.1 billion.

Segment Details

Agricultural Products freight revenues were $922 million, down 4% year over year. Business volumes decreased 7% year over year. Average revenue per car increased 3%.

Automotive accounted for $512 million of freight revenues, down 1% year over year. Business volumes were down 4% and average revenue per car climbed 1% year over year.

Chemicals contributed $917 million to freight revenues, up 7% year over year. Business volumes were up 5%, while average revenue per car improved 2%.

Coal revenues (freight) decreased 5% year over year to $667 million. Business volumes decreased 3% and average revenue per car declined 2% year over year.

Industrial Products generated freight revenues of $1,062 million, up 28% year over year on a 17% growth in business volumes. Average revenue per car was up 10%.

Intermodal segment freight revenues came in at $1,007 million, up 4% year over year. Business volumes were flat year over year, while average revenue per car improved 4%.

Other revenues improved 8% to $363 million in the fourth quarter of 2017.

Liquidity

The company exited 2017 with cash and cash equivalents of $1,275 million compared with $1,277 million at the end of 2016. Debt (due after one year) came in at $16,144 million at the end of the year compared with $14,249 million at the end of 2016. Adjusted debt-to-capitalization ratio decreased to 43.9% from 47.3% at 2016-end.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

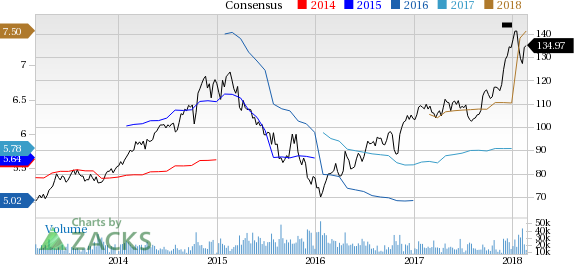

Union Pacific Corporation Price and Consensus

Union Pacific Corporation Price and Consensus | Union Pacific Corporation Quote

VGM Scores

At this time, UNP has a subpar Growth Score of D, a grade with the same score on the momentum front. The stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate investors will probably be better served looking elsewhere.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of this revision looks promising. Interestingly, UNP has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research