Sanofi's (SNY) Q2 Earnings Surpass Estimates, Sales Miss

Sanofi SNY reported second-quarter 2018 earnings of 74 cents per American depositary share, which beat the Zacks Consensus Estimate of 72 cents. Earnings declined 6.7% on a reported basis. At constant currency rates (“CER”), earnings grew 1.5%.

Second-quarter net sales fell 5.7% on a reported basis to almost $9.75 billion (€8.18 billion). Sales also missed the Zacks Consensus Estimate of $9.96 billion. Unfavorable exchange rate movements hurt sales by 5.8%. At CER, sales increased 0.1% year over year.

Sales declined 4.4% at CER in the United States. Sales rose 5.2% in Emerging Markets, remained almost flat in Europe and declined 0.7% in the Rest of the World (Japan, South Korea, Canada, Australia, New Zealand and Puerto Rico).

In the past three months, Sanofi’s shares have risen 10.9% compared with 6% increase for the industry.

All growth rates mentioned below are on a year-on-year basis and at CER.

Segmental Performance

Pharmaceuticals sales (including emerging markets) declined 3.8% to €6.3 billion on a reported basis. However, at CER, Pharmaceuticals sales rose 1.9% driven by growth in Rare Blood Disorder and Immunology franchises, partially offset by lower Diabetes and Established Rx products sales.

Sanofi reports through five Global Business Units (GBUs) — Sanofi Genzyme (Specialty Care), Diabetes & Cardiovascular, General Medicines & Emerging Markets, Consumer Healthcare and Sanofi Pasteur (Vaccines).

Sanofi Genzyme/Specialty Care GBU sales (including emerging markets) increased 29.5% to €2.07 billion, driven by contribution from new immunology drugs — Dupixent and Kevzara — along with higher sales of rare disease drugs. Sales at this GBU grew 14% after consolidating recently acquired, Bioverativ.

Sales of MS drug, Aubagio rose 1.2% to €404 million while sales of Lemtrada fell 12.9% to €102 million.

Sales of rare disease drugs like Myozyme/Lumizyme improved 7.8% to €209 million. Fabrazyme sales were €188 million, up 6.3%. Cerdelga sales came in at €38 million, up 32.3%, and Cerezyme sales rose 2.6% to €181 million.

Oncology sales increased 2.4% to €369 million. Excluding Leukine, which was sold in January, oncology sales grew 5.1%. Jevtana sales were up 10% to €103 million. Thymoglobulin recorded sales of €74 million, up 3.9%. Taxotere sales remained flat at €41 million. Mozobil and Zaltrap sales were up 15% and 38.9% to €44 million and €24 million, respectively.

Dupixent/dupilumab for treating atopic dermatitis was launched in the United States and the EU in 2017. Dupixent generated sales of €176 million in the second quarter compared with €107 million in the previous quarter. Total prescriptions written for Dupixent in the United States grew 27% sequentially.

Sanofi and Regeneron’s REGN rheumatoid arthritis drug, Kevzara (sarilumab) was launched in the United States, United Kingdom, the Netherlands and Germany in 2017. The drug was launched in Japan, Belgium, Sweden and Finland this year. Kevzara recorded sales of €20 million in the quarter compared with €10 million in the previous quarter.

Diabetes and Cardiovascular GBU (including emerging markets) declined 9.4% to €1.51 billion. The Diabetes franchise (including emerging markets) declined 11.9% to €1.37 billion due to lower sales of key drugs – Lantus and Toujeo – in the United States.

Sales of diabetes drugs in the United States declined 30.1% to €525 million due to the previously announced changes in coverage in the Part D business and a persistent decline in average U.S. glargine net prices. Sales of diabetes drugs in Emerging Markets were up 11.8%. In Europe, it rose a mere 0.3%.

Lantus sales declined 20.6% to €891 million in the quarter. Lantus sales declined 33.9% in the United States due to lower average net price and the change in coverage in Sanofi’s Part D business. In Europe, sales declined 9.8% due to biosimilar competition and patient switching to Toujeo.

Toujeo generated sales of €217 million in the reported quarter, up 7.9%. However, sales were down 23% in the United States.

Soliqua/Suliqua generated sales of €17 million in the quarter compared with €9 million in the previous quarter.

In the cardiovascular franchise, Sanofi’s anti PCSK9 therapy, Praluent garnered worldwide sales of €62 million in the reported quarter, up 54.8%.

General Medicines & Emerging Markets GBU sales came in at €3.3 billion, down 3.7%. Sales of Established products were €2.27 billion, down 7.9% as strong performance in emerging markets was offset by lower sales due to generic competition for Renvela/Renagel in the United States.

Sales of Generics fell 1.6% to €402 million with lower sales in Europe partially offset by growing sales in Emerging markets. However, in June, Sanofi signed a share purchase agreement to sell its European generics business, Zentiva, to Advent International. The deal is expected to close in the fourth quarter of 2018.

Consumer Healthcare GBU sales were €1.12 billion, up 4.1% driven by growth in European and Emerging markets. This offset the decline in U.S. sales due to the late onset of allergy season and competition from private labels.

Second-quarter consolidated Sanofi Pasteur (Vaccines) sales fell 15.7% to €811 million. Vaccines sales were impacted by constrained supply of Pentaxim in China and low sales of Menactra.

Costs Rise

Selling general and administrative expenses (SG&A) increased 2.7% at CER in the quarter, reflecting investments in immunology and consolidation of Albynx and Bioverativ’s operating expenses, partially offset by lower expense for the diabetes program. R&D expenses were up 13.1% at CER, reflecting increased spending on immuno-oncology and diabetes programs and acquisition cost related to Bioverativ and Ablynx.

2018 Outlook

Sanofi increased the lower end of its earnings growth expectation for 2018 and expects business earnings to grow between 3% and 5% at CER (previously 2-5%). The company expects sales in Vaccine franchise to grow in mid-single digit in the second half.

Our Take

Sanofi’s second-quarter 2018 earnings beat estimates while sales missed expectations. However, Sanofi’s 2018 outlook looks upbeat as it expects to return to growth this year on the back of a stronger second half. Growth is expected to be driven by the Bioverativ and Ablynx deals, a strong pipeline and decreasing impact of patent expirations. The company continues to execute on its business priorities and looks well poised for a new period of growth with focus on Specialty Care and emerging markets.

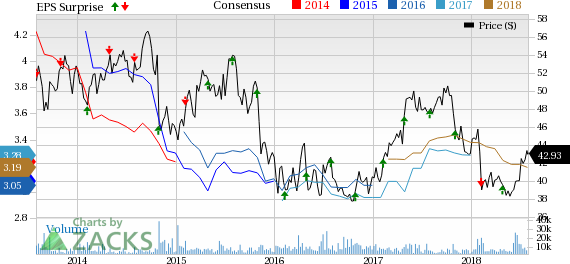

Sanofi Price, Consensus and EPS Surprise

Sanofi Price, Consensus and EPS Surprise | Sanofi Quote

Zacks Rank & Stocks to Consider

Sanofi currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked pharma/biotech stocks include Gilead Sciences, Inc. GILD and Eli Lilly LLY. While Gilead has a Zacks Rank #1, Lilly is a #2 Ranked (Buy) stock.

Gilead’s earnings estimates have risen from $6.11 to $6.22 for 2018 and from $6.36 to $6.37 for 2019 over the past 30 days. The stock has gained 7.3% this year so far.

Lilly’s earnings estimates have increased from $5.15 to $5.37 for 2018 and from $5.47 to $5.62 for 2019 over the past 30 days. The stock has gained 14.4% this year so far.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research