JCPenney: With Sales Sliding, Believers Getting Harder to Find

JCPenney (JCP) was struggling to find defenders Friday, with sales slumping at the department-store owner, its shares following suit and negative sentiment building.

In recent trading, the stock was down 6.6% to $20.26 and near to its 52-week low at $19.06. The selloff came after the Plano, Texas, retailer posted a third-quarter loss of $123 million, or 56 cents a share, with total sales that fell 26.6% from a year earlier to $2.93 billion from $3.99 billion.

Ron Johnson, who has been JCPenney's CEO for roughly a year after joining with great hope from Apple (AAPL), has been trying to implement a makeover for one of America's oldest and best-known retail names. At the moment, he says the merchandiser is "a tale of two companies." In short, one of those is suffering mightily, and the other he hopes will be JCPenney's salvation.

The department-store segment known across the nation's downtowns and malls "continues to struggle and experience significant challenges," Johnson said in a press release. Clearly, that's the bad news. The good news, he says, is that the new shop concept of focusing on various brands in JCPenney stores "is gaining traction with customers every day and is surpassing our own expectations in terms of sales productivity which continues to give us confidence in our long term business model."

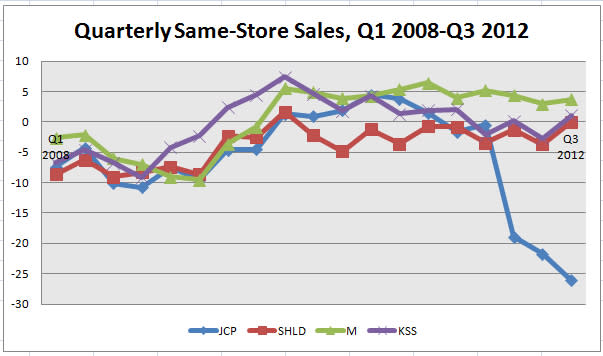

As the chart below shows, same-store sales, a key measure of performance in retail, are facing the harsh reality of the above-mentioned challenges (overall sales dropped from $19.9 billion in fiscal 2007 to $17.3 billion in 2012). If you subscribe to the notion that a picture is worth a thousand words, this visual tells quite a story. Here's a look at JCPenney's quarterly comparable sales going back to the start of 2008 and viewed along with Macy's (M), Sears Holdings (SHLD) and Kohl's (KSS):

(Data from FactSet and company reports)

JCPenney and Johnson, again, a year in, are taking heavy fire these days for results such as this. Critics are all over the place, both questioning the company's in-store strategy -- including a very poorly received attempt to essentially get rid of coupons and sales -- and the company's broad future prospects. When sales are dropping at the rate they are, one can see why optimism might be in short supply.

Retail, apparel and otherwise, is a brutal, competitive, unforgiving sector. Shoppers have dozens of options when it comes to where to buy their clothes, from higher-end places like Saks (SKS) to lower-priced and discount stores like Target (TGT) and TJX (TJX), and from department stores like Penney to specialty shops such as Gap (GPS). Then you've got the entire online apparatus that just gets more popular and massive with each passing year.

JCPenney can look at other retailers and know that it's not over, even if some of the more skeptical viewers are already digging its grave. Rough patches, sometimes very rough patches, hit a company. JCPenney stores aren't going to vanish from the face of the earth before the weekend ends. Engineering a turnaround is possible, and Johnson is asking for more time to make that revival happen. But should he be greeted with confidence that he can? He did lead a successful retail strategy at Apple, for which he's most-known, and prior to that he was at Mervyn's and Target. He knows large-scale retail, and he wasn't given the job at Apple because Steve Jobs thought he would do Johnson a favor. He earned his reputation, which he then burnished at the iPhone seller.

However, now that he's back at big retail, what he's getting are big sales declines, and every indication that investors' faith is fading in the company's ability to stay relevant.

With these baseball-and-apple-pie Americana-type stores, it's hard to watch the suffering. On top of that, the reality is that thousands of people work at JCPenney, in towns of every size, and thousands more depend on the affordable goods sold there -- it's not entirely wistfulness that makes this an important story. It's one we can all relate to. And it's a huge task Johnson's got.

Let us know what you think. Can Johnson turn JCPenney around, and is his strategy the right one for the retailer?