Live Ventures CEO Buys Shares After Company Pulls Out of Red

- By Jennifer Chiou

Jon Isaac (Insider Trades), CEO, CFO and 10% owner of Live Ventures Inc. (LIVE), bought 8,633 shares of the company on April 7. The average price per share was $1.58 for a total transaction cost of $13,640. The company provides local customer acquisition services for small businesses through two primary wholly-owned subsidiaries (Velocity Marketing Concepts Inc. and Local Marketing Experts Inc.). Live Ventures has a market cap of $27.90 million and a P/S ratio of 0.59.

Warning! GuruFocus has detected 5 Warning Signs with LIVE. Click here to check it out.

The intrinsic value of LIVE

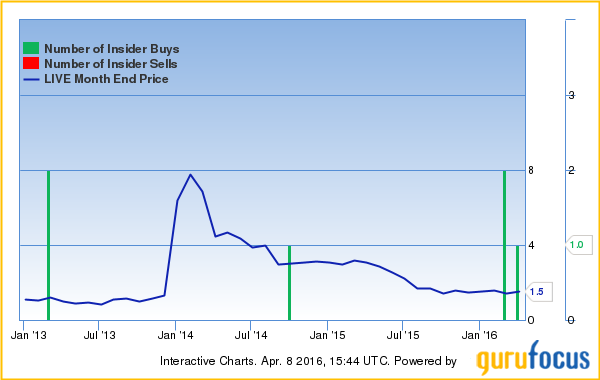

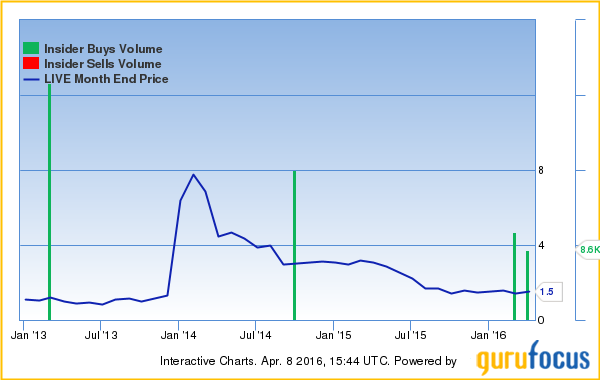

There was only one insider purchase of 100,000 shares in 2014 compared to two insider purchases of 4,335,204 shares in 2013. There were no insider transactions in 2015, and three transactions totaling 23,633 shares in the first three months of 2016. Isaac acquired 4,199,814 shares in seven transactions since Sept. 20, 2012. Isaac's earliest purchase of 1,537,092 shares at an average per share price of $1.48, increased in value by over 200%. The increase in insider purchase volume correlates to a decrease in month-end price.

For more information about insider transactions with LIVE, click here.

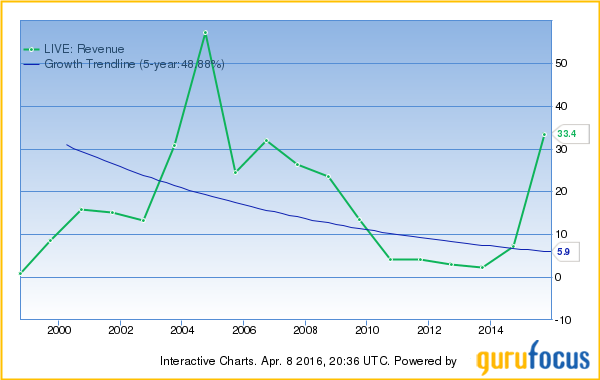

The company reported revenues of $20.104 million for the fourth quarter. This is up from revenues of $8.007 million reported in the year-ago quarter. In the prior year quarter, the company had net loss of $4.947 million or $0.33 per share. In the fourth quarter this year, it earned $176,148, or 1 cent per share. Annual revenue and annual net income increased by 48.88% and 20.59%.

The company announced its subsidiary, Marquis Industries, reported record sales of $7.3 million for March. It is the biggest sales month in the history of the company, even prior to Live Ventures' acquisition. Isaac recognized Marquis' CEO, Tim Bailey and Bailey's team, and commented that the milestone "further demonstrates (the company's) dedication to acquiring revenue-generating companies that will help drive the value of the stock" for the shareholders.

According to GuruFocus.com information, Live Ventures Inc. has a business predictability rank of 1 out of 5 stars. For more information about business predictability rank, click here.

For more stock trades of gurus in real time, visit GuruFocus' Real Time Picks, a Premium Feature. Not a Premium Member of GuruFocus? Try it free for 7 days here.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with LIVE. Click here to check it out.

The intrinsic value of LIVE