It’s all bad news in the restaurant chain business

“To say that the bloom is off the fast casual rose is an understatement,” says Bernstein’s Sara Senatore. In other words, people are eating out less.

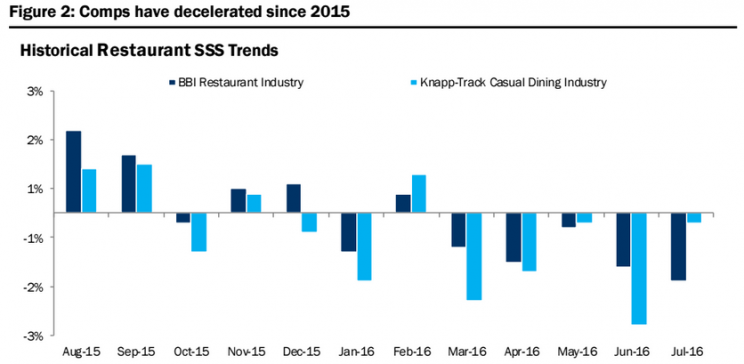

Industry comparable store sales continued their negative streak in the most recent quarter, and management teams are citing everything from US political uncertainty to terrorism for the decline—raising concerns about broader consumer spending patterns.

And Cosi—a struggling player in the industry—filed for bankruptcy, also reflecting challenges.

Olive Garden parent Darden (DRI) said in its first quarter report on Tuesday that the industry was under pressure.

“We assume the industry is going to stay where the industry is going to stay,” Darden CEO Gene Lee said. “We’re not assuming the industry is going to get a whole lot better.”

And on Thursday, Yum Brands (YUM)—parent of Taco Bell, KFC and Pizza Hut—also pointed to industry pressures, specifically competition and reiterated some competitive pressure as well, particularly with its Pizza Hut comparable store sales decline.

“The US market was influenced by an unsuccessful promotion and the competitive environment,” said CEO Greg Creed of the company’s weakest brand. YUM has aimed its value creation efforts on the spin-off of its China business, coming at the end of the month.

The pre-announcement from Sonic (SONC) in September set the tone of even worse-than-expected results to come.

“The shortfall was largely driven by lower-than-expected traffic, reflecting lower consumer spending in restaurants and continued aggressive competitive activity,” said CEO Cliff Hudson in the company’s press release.

These traffic issues come amid company-specific pressures at former industry leader Chipotle (CMG)—which accounted for 19% of industry sales in 2015. Chipotle saw comps decline nearly 27% in first half of the year.

What about the consumer?

So if all of these lackluster results tumble in, should we be worried about the consumer? Not necessarily. Factors working against the fast-casual dining and quick-serve companies may be industry-specific and not suggest underlying weakness for consumers, where strong data continues to be steady, according to Canaccord Genuity’s Lynn Collier.

“We believe the consumer overall is in decent shape given a strong housing market, improving employment and a rising stock market,” Collier wrote in a note.

Instead, a number of issues have had an outsized impact on the restaurant space.

Pricing

Commodity costs are down, making competition more fierce.

Specifically, the gap between “food at home” inflation and “food away from home” inflation has been increasing since the beginning of 2015, according to Collier, which has made the value proposition less attractive for restaurants.

Meanwhile, while declining commodity prices are a good thing for quick-serve input costs, a promotional environment adds more competitive pressure to names, according to analysts.

Wages

Across company conference calls, quick-serve and fast-casual management teams were vocal about labor pressures extending into 2017.

Wage inflation rose 5% in July versus a post-recession average of 2.5%, according to William Blair Research.

Since the beginning of 2016, 12 states have increased their minimum wage, including California, which is up 11% (from $9.00 to $10.00), which is the largest restaurant state in the country.

Meanwhile, the change to the Fair Labor Standards Act (FLSA) in May—which expanded overtime regulation in the US—added additional pressure to restaurants.

While companies—like Panera (PNRA)—have used technology to combat labor pressure, these efforts also require investment dollar outlay.

Unit Growth

Additionally, the US has too many restaurants. According to Canaccord Genuity, supply has been increasing steadily in recent years, with few closures during the recession.

After bottoming in 2009, restaurant employment has been on the rise, reflecting a potential oversupply issue.

In fact, the recent family of initial public offerings in the space in recent years—including Potbelly (PBPB) and Noodles (NDLS)—emphasized unit growth, reflecting the pressure in the space to grow.

More competition

Meanwhile, grocery stores—including Whole Foods (WFM)—have continued to offer more prepared food options, offering formidable competition to quick-serve and casual dining options. And meal delivery options (like Blue Apron) also offer competition for those that are looking to cook at home.

Plus, particularly in large urban areas, novelty options offering an alternative to big chains have increased. While trends don’t look good for fast-casual, the good news is that this doesn’t tell the whole story of consumer sentiment.