Harvard professor identifies the 'worst nightmare' in America right now

“The confused national discourse about our economy and future prosperity in this election year is our worst nightmare,” Harvard Professor Michael Porter writes. “There is almost a complete disconnect between the national discourse and the reality of what is causing our problems and what to do about them. This misunderstanding of facts and reality is dangerous, and the resulting divisions make an already challenging agenda for America even more daunting.”

In its just-released report on competitiveness, “Problems Unsolved and a Nation Divided: State of US Competitiveness,” Harvard Business School (HBS) found the US economy currently faces grave concerns. And the path to a solution—namely tax reform, immigration reform, and infrastructure investment—is being hindered by the current political climate.

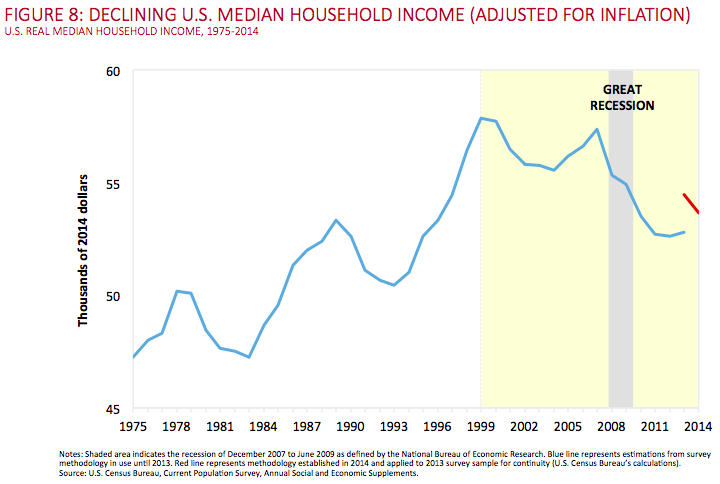

Led by Porter, along with Professors Jan Rivkin and Mihir Desai, the report finds that since the launch of the US Competitiveness Project in 2011, concerns about weak job creation and stagnating incomes—particularly for the middle class—have not waned.

The severe 2009 recession is not the cause of our slow recovery

Porter explains while many pundits and politicians have focused on the Great Recession to diagnose America’s economic woes, this is misguided.

“Despite the hope of finding reasons for optimism, the ‘recovery’ remains slow and uneven, largely because America’s competitiveness problems took root long before the downturn,” Porter writes. “Since those problems remain unsolved, it should not be surprising that the average annual economic growth (1.6%) during the current recovery is slower than during any recovery since the late 1940s.”

The report adds that the wrong diagnosis, along with political paralysis in Washington, has meant that we have made no meaningful progress on any of the critical policy measures needed to address the nation’s underlying competitive weaknesses—which would restore economic growth and also the standard of living for the average citizen.

“America’s economic strategy defaulted to trusting that the Federal Reserve could solve our problems through monetary stimulus,” according to the report.

The key problem: Lack of shared prosperity

Porter says the key issue for America today is a lack of “shared prosperity,” as working and middle-class citizens are struggling.

“The lack of shared prosperity has rightly been a central issue in the 2016 campaign, but the diagnoses and proposed solutions are way off the mark,” the report points out.

As the middle class began to stagnate amid globalization and technological change, instead of increasing investments, the US made “unsustainable promises” to maintain the “illusion of shared prosperity,” the report notes. That included extending credit, expanding entitlements and increasing public-sector benefits.

The report points out that while politicians resort to blame—from immigrants to Wall Street to well-off Americans to other countries, big business and international trade—the solutions offered are “emotionally appealing but simplistic and deeply misguided.”

The HBS report focuses on solutions to make the US more competitive, allowing businesses to compete in domestic and international markets while improving wages and living standards of the average citizen.

“When these occur together, a nation prospers,” according to the report. “When one occurs without the other, a nation is not truly competitive and prosperity is not sustainable.”

Lackluster growth: A breakdown of metrics

The manifestation of competitiveness is productivity, Porter explains. A nation can only compete successfully and pay rising wages through high value of output per worker and per dollar of capital invested.

But productivity growth has been stuck below long-term levels, hitting negative territory in the last three quarters.

Wages have stagnated and business investment is also lagging given uncertain prospects.

As the report highlights, between the 1970s and 1990s, the US economy created private sector jobs at a long-run rate of 2% per year. But the rate, which began to decline around 2001, remains well below historical standards.

The report adds that not only has job growth slowed but most of the jobs created since 2000 have been in “local” industries such as health care, hospitality, and business services. Local jobs—as opposed to “traded jobs” that are exposed to international competitions such as machinery and IT equipment—pay lower average wages.

And slow job creation has led to low workforce participation, or the proportion of working age Americans in the active workforce, which peaked in 1997—well ahead of the Great Recession.

The report points out that while some observers have minimized declining workforce participation to retiring baby boomers, the bigger drivers are weak demand for low-skilled labor along with high incarceration rates of low-skilled men. Meanwhile, baby boomers are actually working longer than historical norms. While the official unemployment rate has improved to 4.9% for the entire population and 5.1% for the working population (ages 16-64), the report points out that if workforce participation stayed at the level seen in 1997, current levels of employment would imply a rate of 11.1% for the working population.

“Given the number of potential workers sitting on the sidelines, not in the official workforce but eligible to work, talk of a tightening labor market seems premature, especially for lower-skill and lower-income workers,” according to the report.

This helps set the stage for why wages and income levels for Americans have been under pressure, particularly for lower-income groups.

Meanwhile, the annual growth rate of quarterly private investment in intellectual property, structures and equipment remains weak, falling below historical rates, according to the report. For 2010-2016, the average quarterly investment by business as a percent of GDP was lower than it has been since the 1980s, hurting productivity further.

And all of this comes as GDP growth has remained tepid for a longer period than realized, on a downward trajectory since the 1960s with a significant step-down beginning around 2000.

Porter says the key barrier to progress is the political system.

“We’ve concluded after these five years of work on this that actually the political system and the political rhetoric is the problem at the core,” Porter said. “Because of the political gridlock we’ve not been able to make any progress on a lot of the basics.”

For more on the study, please see below:

Harvard economist never thought his new study would take him where it did

Harvard study singles out a game-changing economic opportunity: TAX REFORM

There’s a silver lining behind the dark clouds hanging over US businesses

Harvard Business Dean tells us what this huge 5-year study is all about

Harvard Business Dean: The post-crisis monetary policy is ‘running out of runway’

How improved infrastructure could end America’s vicious cycle of poverty

Some companies have taken the next obvious step to filling jobs that sit vacant

There’s one piece of tax reform that would have a real impact with little resistance

America’s outdated education system isn’t producing the workers companies need

Revitalizing small businesses is key to drive America’s economic growth