Can Keytruda Deliver Earnings Growth For Merck?

Earnings season keeps rolling along this week with automotive giants and a handful of pharmaceutical titans that will offer a distinct and noteworthy take on the economy and consumers.

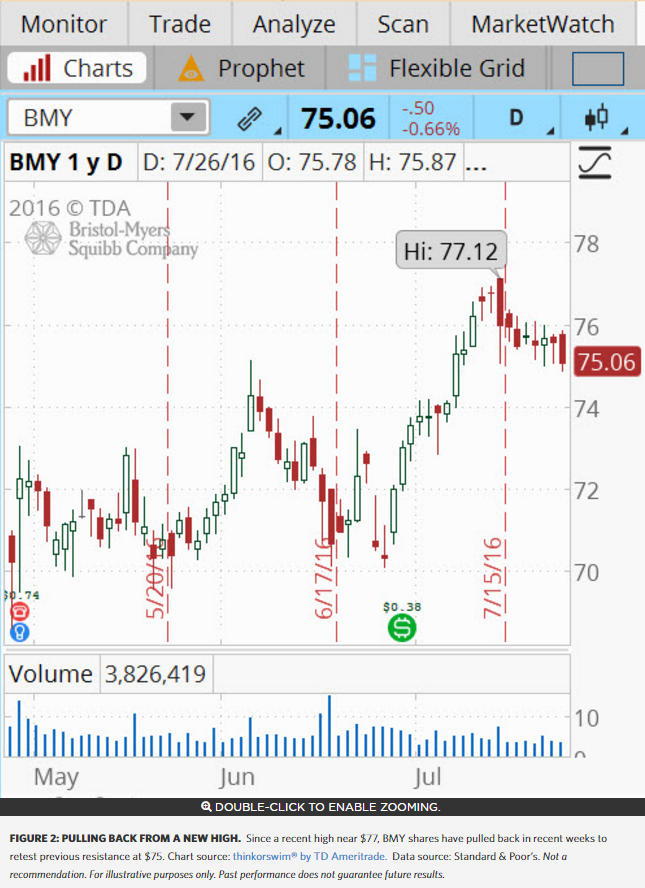

Ford Motor Company (NYSE: F) is reporting earnings Thursday morning, as is pharma behemoth Bristol-Meyers Squib Co (NYSE: BMY). Ahead of the opening bell Friday, BMY rival Merck & Co., Inc. (NYSE: MRK) is set to report.

What’s Driving Sales of Ford SUVs and Trucks?

When F reports Thursday, analysts say they’ll be looking for strong numbers on sales of SUVs and pickup trucks, two big contributors to higher margins.

F already has reported that Q2 U.S. production is ahead 14% over the year-ago results.

But let’s not forget about Brexit, which F has said for some time may present a risk to the business. About 19% of F’s total topline comes from European sales.

Analysts say they also want to finally find out what the new transportation services business will entail. F has said that it includes models not typically part of most automakers, like public transportation buses and passenger rail, as well as cabs, but has revealed precious few details.

Analysts reporting to Thomson Reuters are forecasting per-share earnings of $0.60, a 28% jump from the year-ago profit of $0.47 per share. Revenues are projected to climb 3.4% to $36.31 billion from last year’s $35.1 billion.

Short-term options traders have priced in a potential 3% share price move in either direction around the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform by TD Ameritrade.

In the options market, there’s been active trading for calls at the 14-strike and the 13½- and 14½-strike lines. The implied volatility is at the 45th percentile. (Please remember past performance is no guarantee of future results.)

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over a set period of time. Put options represent the right, but not the obligation, to sell the underlying security at a predetermined price over a set period of time.

BMY Profit Might Grow Double-Digits

One problem many big pharma companies face is losing patents on drugs that have been blockbusters, but soon will have generic competition. BMY has seen their patents expire for Plavix, a successful product for the company, and, more recently, Abilify.

But analysts hope that sales of Opdiva, a cancer drug, will help offset some of the patent expirations. Eliquis, an anti-coagulant drug, also has been successful, as has Orencia, the rheumatoid arthritis medicine, analysts say. Of course analysts will want to know what’s under development and in the pipeline.

Profit growth at BMY has been sluggish in recent years, but that might change this quarter. Analysts reporting to Thomson Reuters are forecasting a per-share profit of $0.66, up 25% from $0.53 a year ago. Total sales are seen rising 12% to $4.7 billion.

Short-term options traders have priced in a potential share-price move of 2% in either direction around the earnings release, according to the Market Maker Move indicator.

Options trading has been thin in BMY. The implied volatility is at the 31st percentile.

Can Keytruda Deliver for MRK?

MRK’s got the same patent issue BMY has, and MRK also has a blockbuster cancer drug, Keytruda, to help boost its top and bottom lines. But will it be enough to offset patent expirations? MRK might also see a sales boost from Zepatier, which fights hepatitis C, and Januvia, a Type 2 diabetes medication. What other products does it have in the channel?

Analysts at Thomson Reuters are looking for 6% earnings growth to $0.91 a share from $0.86 a year ago. MRK has beat analysts’ expectations in 14 of the last 15 quarters. Revenue is expected to be flat at $9.8 billion.

Short-term options traders are anticipating a potential 2% share price move in either direction around the earnings release, according to the Market Maker Move.

Options trading in MRK has been light. The implied volatility is at the 35th percentile.

TD Ameritrade and all third parties mentioned are separate and unaffiliated companies, and are not responsible for each other’s policies or services.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2016 TD Ameritrade IP Company, Inc. All rights reserved. Used with permission.

See more from Benzinga

© 2016 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.