Some ETFs Saying a Salix Takeover Could be Afoot

Shares of Salix Pharmaceuticals (SLXP) are trading higher by 2.6% Friday on volume that is quickly approaching triple the daily average on news that the company is mulling a sale of itself to generic drug maker Actavis (ACT).

“Though no deal is imminent, an agreement between Salix and Actavis has become more likely in the past week,” report David Welch and Jeffrey McCracken for Bloomberg.

News of Actavis comes about six weeks after other outlets reported that Botox maker Allergan (AGN) was mulling a run at Salix in an effort to stave off a $53 billion hostile bid from Valeant Pharmaceuticals (VRX). [ETFs for a Salix Takeover]

Just last week, it was reported that Dow component Pfizer (PFE) is mulling a takeover of Actavis to gain access to the latter’s Irish domicile, which allows for considerable tax savings. [Of Inversion and Pharma ETFs]

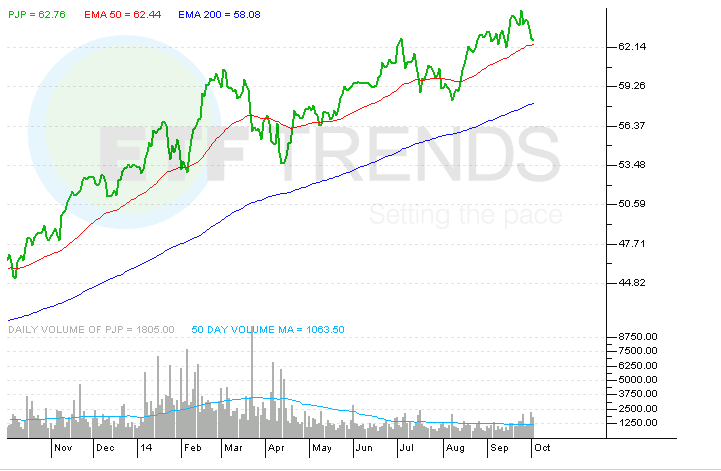

Although the Bloomberg report says an Actavis-for-Salix deal is not imminent, there are signs some exchange traded funds are pricing in the possibility Salix will be acquired. For example, the PowerShares Dynamic Pharmaceuticals Portfolio (PJP) , one of this year’s top-performing health care ETFs, is higher by 2% on volume that is 73% above the trailing three-month daily average.

Combined, Allergan, Actavis and Salix combine for 9.7% of PJP’s weight. Interestingly, the ETF added $19.2 million in new assets for the week ended Oct. 2, more than any other PowerShares ETF except for the PowerShares FTSE RAFI US 1000 Portfolio (PRF), according to issuer data.

The First Trust Health Care AlphaDEX Fund (FXH) , which features Salix and Actavis as its fifth- and seventh-largest holdings, respectively, is higher by nearly 2% today as well. Salix, Actavis and Allergan, in that order, combine for over 7% ofFXH’s weight.

Adding some intrigue to the notion of a Salix takeover, one institutional trading desk said there is solid activity today in the Salix November $170 call options. The stock would need to rise nearly 10% to provide profits for buyers of those calls.

The iShares U.S. Pharmaceuticals ETF (IHE) , which allocates a combined 8.6% of its weight to Actavis and Salix, is up 1.8% on volume that is already more than 40% above the daily average.

PowerShares Dynamic Pharmaceuticals Portfolio