The Top 20 Wall Street Analysts Of 2015

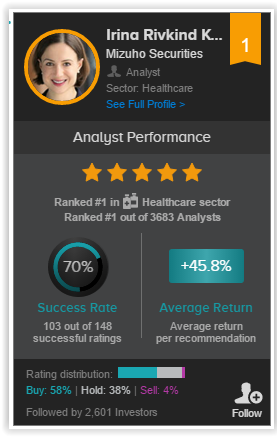

1. Irina Rivkind Koffler

Mizuho Securities

103 out of 148 successful ratings (70 percent)

focuses on the biotech industry. Some of her recent Buy ratings in the past month included Teva Pharmaceutical Industries Ltd (ADR) (NYSE: TEVA), Allergan plc Ordinary Shares (NYSE: AGN) and Valeant Pharmaceuticals Intl Inc (NYSE: VRX). This month, the analyst initiated a Buy rating on Eagle Pharmaceuticals Inc (NASDAQ: EGRX) with a price target of $112. Koffler’s only Hold rating of the past month was for Mallinckrodt PLC (NYSE: MNK). The analyst has a 70 percent success rate, according to TipRanks.

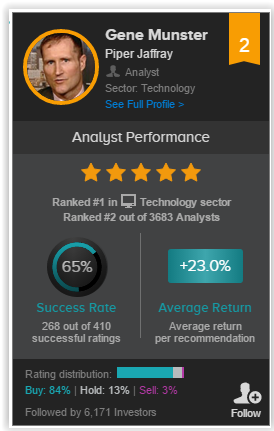

2. Gene Munster

Piper Jaffray

268 out of 410 successful ratings (65 percent)

has made several Buy ratings for major tech companies in the past few months. Most recently, the analyst maintained a Buy rating on TubeMogul Inc (NASDAQ: TUBE) with a price target of $23. The analyst also gave consistent Buy ratings for Yahoo! Inc. (NASDAQ: YHOO), Apple Inc. (NASDAQ: AAPL) and Amazon.com, Inc. (NASDAQ: AMZN) with price targets of $39, $179 and $800, respectively. He has a 65 percent success rate.

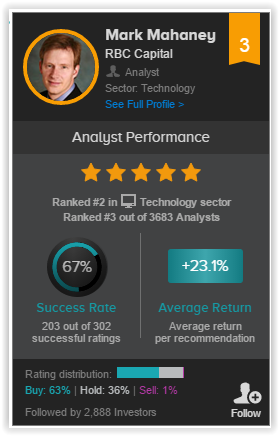

3. Mark Mahaney

RBC Capital

203 out of 302 successful ratings (67 percent)

covers the technology industry. While he upgraded Yelp Inc (NYSE: YELP) to Buy, the analyst also reiterated Buy ratings for Alibaba Group Holding Ltd (NYSE: BABA), Expedia Inc (NASDAQ: EXPE) and Netflix, Inc. (NASDAQ: NFLX). Mahaney’s only recent hold rating was for Yahoo! Inc. (NASDAQ: YHOO) with a price target of $42. The analyst has a 67 percent success rate.

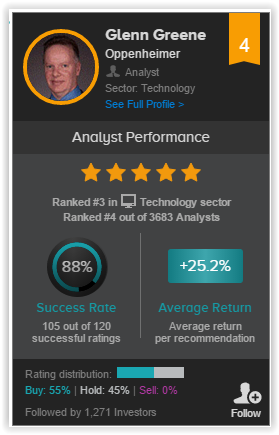

4. Glenn Greene

Oppenheimer

105 out of 120 successful ratings (88 percent)

also rates companies in the technology industry, with a focus on financial companies as of late. In the past six months, the analyst gave Buy ratings for WEX Inc (NYSE: WEX), Visa Inc (NYSE: V) and Jack Henry & Associates, Inc. (NASDAQ: JKHY), while initiating a Buy rating on First Data Corp (NYSE: FDC) with a $20 price target. The analyst gave only one hold rating in the past six months on FactSet Research Systems Inc. (NYSE: FDS) with no price target.

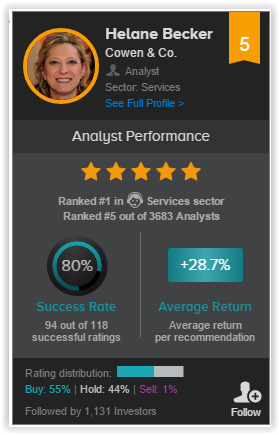

5. Helane Becker

Cowen & Co.

94 out of 118 successful ratings (80 percent)

covers companies in the services industry. Recently, the analyst gave Buy ratings on airlines Spirit Airlines Incorporated (NASDAQ: SAVE), Alaska Air Group, Inc. (NYSE: ALK) and Southwest Airlines Co (NYSE: LUV) and Hold ratings on Hawaiian Holdings, Inc. (NASDAQ: HA) and Anglo American plc (LON: AAL).

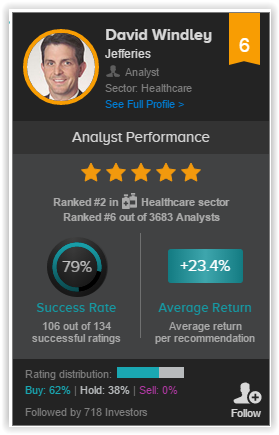

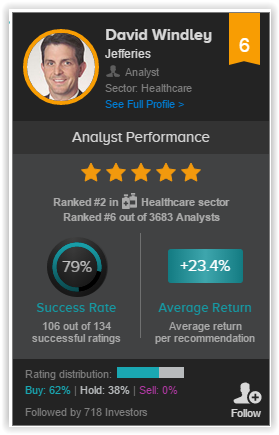

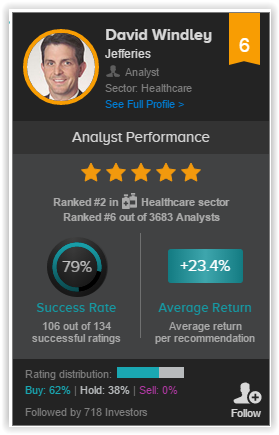

6. David Windley

Jefferies

106 out of 134 ratings (79 percent)

focuses on companies in the healthcare industry. In the past six months, Windley upgraded INC Research Holdings Inc (NASDAQ: INCR) and Centene Corp (NYSE: CNC) to Buy with a price target of $51 and $88, respectively. The analyst also gave Buy ratings for Quintiles Transnational Holdings Inc (NYSE: Q) and Aetna Inc (NYSE: AET), but downgraded Catalent Inc (NYSE: CTLT), PAREXEL International Corporation (NASDAQ: PRXL) and Health Net, Inc. (NYSE: HNT) to Hold.

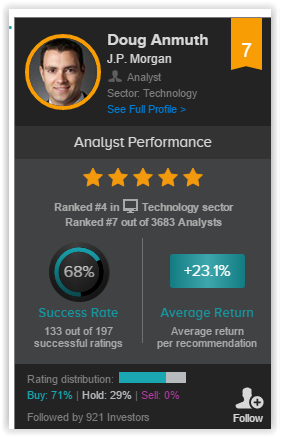

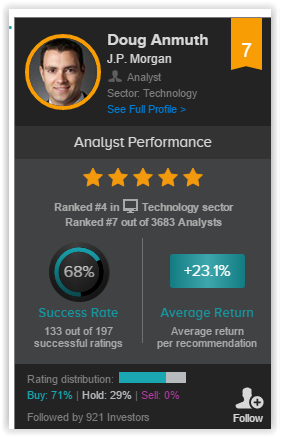

7. Doug Anmuth

JPMorgan

133 out of 197 successful ratings (68 percent)

Analyst rates technology companies. In the past three months, Anmuth gave a Buy rating to tech giants including Facebook Inc (NASDAQ: FB), Alibaba Group Holding Ltd (NYSE: BABA) and Amazon.com, Inc (NASDAQ: AMZN). His most recent rating was for Match Group Inc (NASDAQ: MTCH), initiating a hold with a price target of $16.

8. Youssef Squali

Cantor Fitzgerald

187 out of 293 successful ratings (64 percent)

also covers the technology sector. He gave several Buy ratings in the past few months to companies such as Yahoo! Inc. (NASDAQ: YHOO), Alibaba Group Holding Ltd (NYSE: BABA), Facebook Inc (NASDAQ: FB), LinkedIn Corp (NYSE: LNKD) and Alphabet Inc (NASDAQ: GOOGL). Squali has a 64 percent success rate, according to TipRanks.

9. David Nierengarten

Wedbush

53 out of 98 successful ratings (54 percent)

covers companies in the biotech sector. The analyst most recently initiated a Buy rating for Voyager Therapeutics Inc (NASDAQ: VYGR) with a price target of $36. He also gave Buy ratings for Cerulean Pharma Inc (NASDAQ: CERU), bluebird bio Inc (NASDAQ: BLUE) and Cidara Therapeutics Inc (NASDAQ: CDTX). The analyst gave Hold ratings for Raptor Pharmaceutical Corp. (NASDAQ: RPTP) and Fibrocell Science Inc (NASDAQ: FCSC), upgrading Raptor with a price target of $7.00 while downgrading Fibrocell with a price target of $6.00.

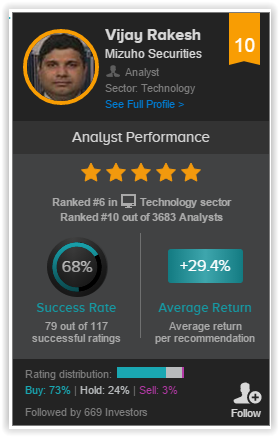

10. Vijay Rakesh

Mizuho Securities

79 out of 117 successful ratings (68 percent)

Analyst also rates technology companies. In the past six months, the analyst initiated a Buy rating on Microsemi Corporation (NASDAQ: MSCC) with a price target of $42 and PMC-Sierra Inc (NASDAQ: PMCS) with a price target of $14. He was also bullish on companies such as Avago Technologies Ltd (NASDAQ: AVGO), Micron Technology, Inc. (NASDAQ: MU) and Qorvo Inc (NASDAQ: QRVO). Rakesh gave two Hold ratings on Advanced Micro Devices, Inc. (NASDAQ: AMD) and Intel Corporation (NASDAQ: INTC).

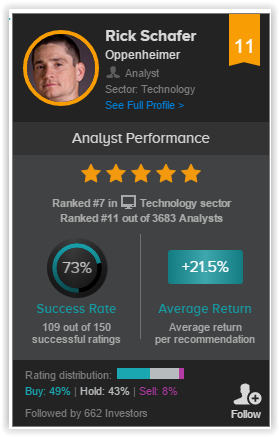

11. Rick Schafer

Oppenheimer

109 out of 150 successful ratings (73 percent)

Analyst covers companies in the technology industry. In the past two months, the analyst gave Buy ratings to companies such as Avago Technologies Ltd (NASDAQ: AVGO), Monolithic Power Systems, Inc. (NASDAQ: MPWR) and Linear Technology Corporation (NASDAQ: LLTC) and a Sell rating to Advanced Micro Devices, Inc. (NASDAQ: AMD). The analyst also gave Hold ratings to Qorvo Inc (NASDAQ: QRVO) and Intel Corporation (NASDAQ: INTC).

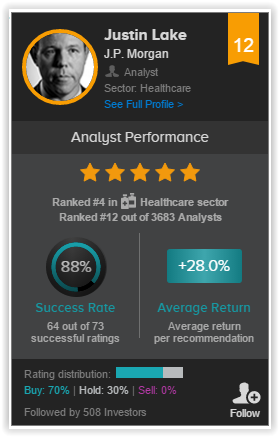

12. Justin Lake

JPMorgan

64 out of 73 successful ratings (88 percent)

’s specialty is healthcare stocks. In the past three months the analyst has initiated ratings on several companies, including Buy ratings on Humana Inc (NYSE: HUM), UnitedHealth Group Inc (NYSE: UNH), CIGNA Corporation (NYSE: CI) and Aetna Inc (NYSE: AET) with price targets of $210, $150, $175 and $144, respectively. Lake initiated Hold ratings on Molina Healthcare, Inc. (NYSE: MOH), HCA Holdings Inc. (NYSE: HCA), Tenet Healthcare Corp (NYSE: THC), Community Health Systems (NYSE: CYH) and LifePoint Health Inc (NASDAQ: LPNT) with price targets of $84, $98, $52, $56 and $79, respectively.

13. Brian Schwartz

Oppenheimer

107 out of 146 successful ratings (73 percent)

specializes in the technology sector. His most recently gave a Buy rating to Xactly Corp (NYSE: XTLY) with a price target of $12. Within the past month, the analyst initiated a Buy rating on Instructure Inc (NYSE: INST) with a price target of $25 and downgraded Textura Corp (NYSE: TXTR) to Hold.

14. Michael Wiederhorn

Oppenheimer

126 out of 187 successful ratings (67 percent)

Healthcare companies are ’s area of expertise. In the past two months, the analyst gave seven Buy ratings, including UnitedHealth Group Inc (NYSE: UNH), LHCG Group, Inc. (NASDAQ: LHCG), Community Health Systems (NYSE: CYH), Anthera Pharmaceuticals Inc (NASDAQ: ANTH) and Centene Corp (NYSE: CNC). Last month, he remained on the sidelines for LifePoint Health Inc (NASDAQ: LPNT), offering a Hold rating without a price target.

15. Colin Sebastian

Robert W. Baird

105 out of 141 successful ratings (74 percent)

rates technology companies, recently focusing on ecommerce and gaming. In the past month, the analyst gave Buy ratings on Electronic Arts Inc. (NASDAQ: EA), Shutterfly, Inc. (NASDAQ: SFLY), GameStop Corp. (NYSE: GME), Paypal Holdings Inc (NASDAQ: PYPL) and Facebook Inc (NASDAQ: FB). He remains on the sidelines for companies such as ChannelAdvisor Corp (NYSE: ECOM) and Zynga Inc (NASDAQ: ZNGA).

16. Kevin Cassidy

Stifel Nicolaus

89 out of 129 successful ratings (69 percent)

rates technology firms, focusing on several semi-conductor companies in the past six months. The analyst was bullish on firms such as Ambarella Inc (NASDAQ: AMBA), Synaptics, Incorporated (NASDAQ: SYNA), Micron Technology, Inc. (NASDAQ: MU) and SanDisk Corporation (NASDAQ: SNDK), but downgraded Cavium Inc (NASDAQ: CAVM) to Hold with a price target of $70.

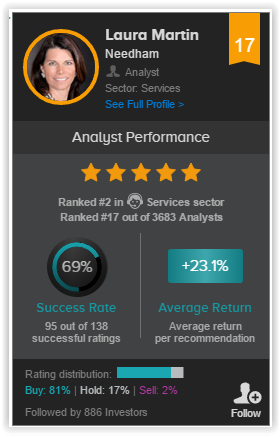

17. Laura Martin

Needham

95 out of 138 successful ratings (69 percent)

focuses on the services sector and has rated many internet giants in the last few months, giving a Buy rating to companies such as COMSCORE, Inc. (NASDAQ: SCOR), Facebook Inc (NASDAQ: FB), Yahoo! Inc. (NASDAQ: YHOO) and Netflix, Inc. (NASDAQ: NFLX). Recently, the analyst remained on the sidelines for Viacom, Inc. (NASDAQ: VIAB) and Tripadvisor Inc (NASDAQ: TRIP).

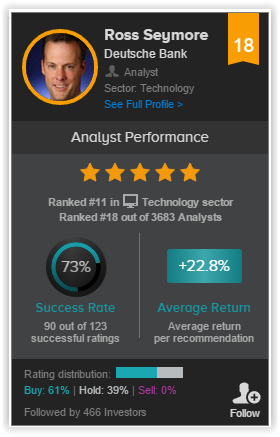

18. Ross Seymore

Deutsche Bank

90 out of 123 successful ratings (73 percent)

covers a range of technology companies. In the past month, the analyst gave a Buy rating for NXP Semiconductors NV (NASDAQ: NXPI), Intel Corporation (NASDAQ: INTC) and Maxim Integrated Products Inc. (NASDAQ: MXIM), while remaining on the sidelines for Marvell Technology Group Ltd. (NASDAQ: MRVL), Ambarella Inc (NASDAQ: AMBA), Analog Devices, Inc. (NASDAQ: ADI) and NVIDIA Corporation (NASDAQ: NVDA). Seymore has a 73 percent success rate.

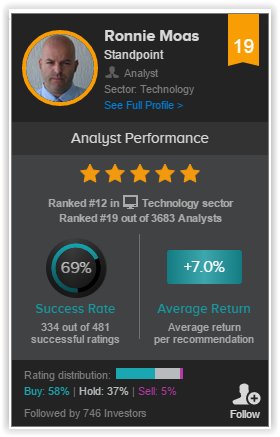

19. Ronnie Moas

Standpoint

334 out of 481 successful ratings (69 percent)

rates companies in a variety of industries. His most recent rating was for Shoe Carnival, Inc. (NASDAQ: SCVL), upgrading the company to Buy without a price target. In the past month he also upgraded CA, Inc. (NASDAQ: CA) to Buy with a price target of $33 and First Solar, Inc. (NASDAQ: FSLR) to hold with a price target of $18. The analyst initiated a Buy rating for ANI Pharmaceuticals Inc (NASDAQ: ANIP) with a price target of $54. The analyst also downgraded American International Group Inc (NYSE: AIG) and Kite Pharma Inc (NASDAQ: KITE) to Hold, with price targets of $74 and $100 respectively.

20. James Mitchell

Buckingham

24 out of 28 successful ratings (86 percent)

has looked at many financial institutions over the past year. He gave Buy ratings for JPMorgan Chase & Co. (NYSE: JPM), Bank of America Corp (NYSE: BAC), Citigroup Inc (NYSE: C) and Raymond James Financial, Inc. (NYSE: RJF). The analyst downgraded Morgan Stanley (NYSE: MS) to Hold with a price target of $38.

Image Credit:

Latest Ratings for AAPL

Dec 2015 | Barclays | Maintains | Overweight | |

Dec 2015 | BMO Capital | Initiates Coverage on | Outperform | |

Nov 2015 | Goldman Sachs | Upgrades | Buy | Conviction Buy |

View More Analyst Ratings for AAPL

View the Latest Analyst Ratings

See more from Benzinga

3D Systems Management Shakeup Makes Stock Attractive, Stephens Says

Qualcomm Is Worth Far More Than Per Share; JPMorgan Pounds The Table

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.