NoSQL databases eat into the relational database market

Of any enterprise technology, enterprises are most dedicated to their chosen database. Once data goes into a particular database, CIOs hate to take it out. It's costly, and the risks often outweigh the benefits.

Which is why it's so fascinating to delve into jobs, social media, and other numbers that indicate ever-rising interest in NoSQL databases. Clearly, something big is happening to the database market, driven in significant part by Big Data adoption.

While Oracle isn't going out of business anytime soon, there's clearly a bright future for NoSQL.

The rise and rise of NoSQL

Measured solely by the volume of mentions (social media, news articles, etc.), MongoDB clearly dominates the database field. (Note that the Cassandra data is unfortunately difficult to collect because "Cassandra" is a term that is used for a wide array of non-database-related topics and so is hard to accurately filter.)

What is most interesting in the media mentions data, however, is the trajectory: all NoSQLs are growing, and some quite substantially, and mostly at MySQL's expense (Figure A).

Figure A

Database popularity.

Oracle and SQL Server (not shown in this data) remain roughly constant (IBM DB2 continues to slide, however), as does PostgreSQL.

But MySQL? The former poster child for open source keeps plummeting.

Once we add in jobs data and other measures of database interest, as the DB-Engines ranking does (Figure B), we still see a marked increase in the top NoSQL databases at the expense of MySQL.

Figure B

DB-Engines ranking.

Strip away the trends and just look at the raw numbers and it's clear that the NoSQLs have a long way to go (Figure C).

Figure C

NoSQLs have a long way to go.

But it's equally clear that they're headed in the right direction, and that except for Oracle, the traditional relational databases, and particularly MySQL, are all taking a bit of a beating at the hands of NoSQL databases. In fact, it's fair to say that most of NoSQL's immediate gains are coming at MySQL's expense.

Why? Because MySQL initially took off with the newer workloads (requiring scale, etc.) and younger developers. Now that there's an alternative that better fits these workloads, it's easier to shed that free, open source database for another free, open source database than to dump Oracle or SQL Server, both of which come with a hefty price tag.

Yes, ironic as it may sound, the huge cost of Oracle is often it's greatest defense.

Oracle: Selling less of the past every day

Yet even Oracle has its work cut out for it. As Aerospike VP (and former Wall Street analyst) Peter Goldmacher declares, "All the legacy guys are going to die... [but Oracle is] going to die last." In part this is because Oracle is the best engineered database product among the traditional RDBMSes. But in part it's because it's the market share leader, and claims fealty from a generation of database admins.

Hence, Oracle's death won't come in some cataclysmic event. Rather, following T.S. Eliot's classic lines, "This is the way [Oracle's database] world ends, Not with a bang but a whimper."

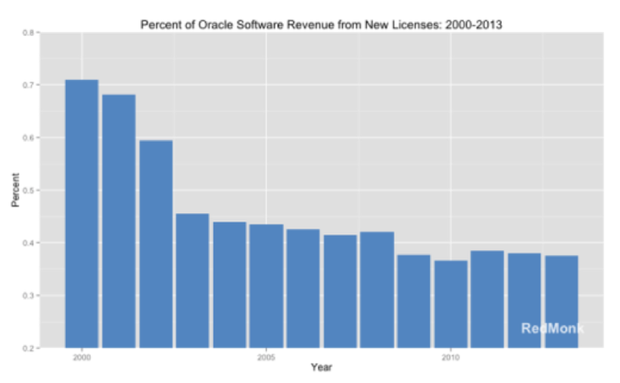

Looking at Oracle's new license revenue makes this clear. For years the company's new license revenue has hovered around 37% of total revenue. As Redmonk analyst Stephen O'Grady puts it, "With or without cloud revenue included...a distinct minority - and declining percentage - of the overall Oracle revenue [is] derived from the sale of new licenses."

Here's what that looks like, again channeling O'Grady's analysis (Figure D):

Figure D

Percent of Oracle software revenue from new licenses.

In short, "Oracle's software revenue growth is increasingly coming not from new customers but from existing customers," as the database giant milks its installed base for more (and more).

But that same installed base is clearly looking beyond Oracle for new workloads that fit the NoSQL mold. The battle, then, is not for yesterday's workloads: if you have an app happily running on Oracle (or SQL Server, or DB2), there's little reason to change it.

But for that next app that involves constantly changing data types or runs at a scale that benefits from horizontal, commodity scale...you're going to be better off running such a modern workload on a modern database.

Seeing the future

Just don't expect to see wild swings in market share today. As can be seen above in the first set of charts, the real movement today starts with the share of voice in the industry. As people move to newer data needs, they increasingly talk about MongoDB and Cassandra, among other NoSQL systems, to address those needs.

Talk, however, is cheap.

Which is why the next phase of NoSQL roll-outs can be seen in the jobs numbers. In terms of absolute numbers, MySQL still dwarfs any NoSQL system, as Indeed data shows, though both Oracle, SQL Server, and MySQL show clear declines in absolute job postings.

But look at relative growth, and it's even clearer where things are heading (Figure E):

Figure E

Job trends from Indeed.com.

As Big Data becomes bigger, the enterprise will increasingly rely on Hadoop and these leading NoSQL databases. As implied above, you're not going to see NoSQL databases unseating RDBMSes for established workloads so much as taking control of an increasing share of new workloads.

At first, this is hitting MySQL hardest. But over time, every RDBMS, including Oracle, is at risk.