Sorrento (SRNE): First Cancer Product Cynviloq Could Reach the Market in 2016

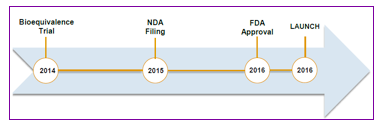

NASDAQ:SRNE Sorrento Reports In-Line Financial Results for 1Q15 Total revenue for 1Q15 was $0.98 million, compared to $0.98 million for 1Q14. First quarter revenue included grant revenue of $0.24 million and service revenue of $0.74 million. R&D expenses were $7.8 million for 1Q15 compared to $5.3 million for 1Q14. G&A expenses were $2.2 million for 1Q15 compared to $2.4 million for 1Q14. Operating loss for 1Q15 was $10.2 million compared to $8.0 million for 1Q14. Net loss in 1Q15 was $10.4 million ($0.29/share), compared to net loss of 10.1 million ($0.44/share) for 1Q14. As of March 31, 2015, Sorrento held $60.5 million in cash and cash equivalents. Positive Results Announced for the Cynviloq™ Registrational TRIBECA™ Study On May 4, Sorrento (SRNE) announced positive results from recently analyzed pharmacokinetic (PK) data from its TRIBECA registrational trial. Data analysis suggests that Cynviloq meets the bioequivalence (BE) criteria for both total and unbound paclitaxel. The ongoing safety assessment from treated patients continues to reveal no unexpected adverse events and the safety data is consistent with the toxicity profile reported in the literature with albumin-bound paclitaxel. We expect Sorrento to disclose the detailed data soon. Following are the previously reported positive data. In January, Sorrento announced the completion of enrollment in the Cynviloq registrational TRIBECA study. Total of 111 patients has been randomized. Patients were enrolled globally from sites in USA, Eastern Europe, and Asia. In October 2014, Sorrento announced positive pharmacokinetic (PK) data from the first eight patients enrolled in the TRIBECA study. The Original Design of Pivotal Trial of Cynviloq In March, 2014, Sorrento initiated the pivotal clinical trial of Cynviloq for the treatment of metastatic breast cancer and non-small cell lung cancer. The registration trial is referred to as TRIBECA™ (TRIal designed to evaluate BioEquivalence between Cynviloq™ and Abraxane®), which is an open-label, randomized, multi-center, single-dose, crossover registration study being conducted at clinical sites across the U.S., EU, and Singapore. Based on the End-of-Phase II meeting with the FDA in July 2013, this trial was designed to gain marketing approval for Cynviloq under the 505(b)(2) regulatory pathway in the U.S. using Abraxane as the reference drug. The 505(b)(2) BE trial design will enroll 100 patients with MBC and include a crossover 2 cycle design. The first cycle of the trial will involve 50 patients in the Abraxane® arm and 50 patients in the Cynviloq arm. The second cycle of the trial will crossover the patients into the opposite treatment groups. Dosage for both drugs will be 260 mg/m2 with 30 minutes infusion. The endpoints will be AUC and Cmax (90% CI). The BE trial will take about 12 months to complete, which will consume roughly $5 million in direct cost. The Positive Initial PK Data The following chart illustrates the initial data from the first 8 patients. The almost coincidental curve between Cynviloq and Abraxane indicates that Cynviloq and Abraxane have similar pharmacokinetics in the patients. These data support earlier completion of the study. The Modified Trial Protocol Sorrento amended the current BE cross-over design protocol of the TRIBECA study to un-blind the first 8 patients to reassess the sample size of 100 patients estimated from simulation of historical PK data. The Company does not plan to un-blind additional patient data. Current sample size point estimates suggest that the enrollment target for the current study can be reduced to nearly half of the original target. Based on the initial positive data, Sorrento plans to reduce the TRIBECA patient sample size to 53 patients to accelerate filing for FDA approval of Cynviloq. Sorrento expects to file a New Drug Application with the FDA in the first half of 2015. According to this schedule, we expect the FDA approval and launch of Cynviloq in 2H2016. Also, in early May 2015, Sorrento announced that its fully owned subsidiary, IGDRASOL, has acquired exclusive distribution rights from South Korean’s Samyang Biopharmaceuticals to Cynviloq™ in South America. Sorrento Establishes Collaboration with Nantworks The Deals In Dec, 2014, Sorrento entered into a binding agreement with NantWorks founder, physician scientist, and biotechnology entrepreneur Dr. Patrick Soon-Shiong. Pursuant to the agreement, NantWorks and Sorrento will establish a first joint venture NantiBody, LLC to jointly develop next generation immunotherapies for the treatment of cancer and auto-immune diseases. The Immunotherapy Antibody JV will be an independent biotechnology company with $20 million initial joint funding. As part of a strategic investment, Dr. Soon-Shiong's affiliated entity will acquire a 19.9% equity stake in Sorrento by purchasing common stock priced at $5.80 per share. In addition, Sorrento granted the investor a 3-year warrant to purchase 1,724,138 shares of common stock at an exercise price of $5.80 per share. The JV will focus on the development of multiple immuno-oncology monoclonal antibodies (mAbs) for the treatment of cancer, including but not limited to anti-PD-1, anti-PD-L1, anti-CTLA4 mAbs, and other immune-check point antibodies as well as antibody drug conjugates (ADCs) and bispecific antibodies. It’s our belief that Nantworks will provide the majority of the initial $20 million funding for the joint venture and that Sorrento will provide its technology and some cash funding for the JV. In Mar, 2015, the two companies entered into another binding agreement to initiate a global collaboration to discover and develop novel anti-cancer immunotherapies derived from Sorrento's proprietary G-MAB® library against neoepitopes of tumor-specific antigens discovered using NantWorks' proprietary pan-omics based, precision medicine approach. Under the terms of the agreement, Sorrento will exclusively license to NantCell, LLC, a NantWorks company, certain antibodies and CAR-TNK™ products in exchange for $10 million in cash and $100 million in NantCell's equity. In addition to the equity and cash payments, Sorrento will also have a share of all future profits resulting from the collaboration. Our Takeaways from the Two Deals This is extremely exciting news for Sorrento in a few aspects. First, the deals immediately boosts Sorrento’s balance sheet. Proceeds from the 19.9% equity investment generates over $40 million cash to Sorrento. The warrants will generate another $10 million for Sorrento if Nantworks chooses to exercise. The second deal also provides $10 million in cash and $100 million in NantCell’s equity for Sorrento. As of December 31, 2014, Sorrento had $72 million in cash and cash equivalents. Current cash balance can at least last into mid-2016. Second, the deal with NantWorks further validates Sorrento’s antibody technology. Over the years, Sorrento has developed two important drug development platforms: G-MAB® library and antibody drug conjugate (ADC) technology. Sorrento’s G-MAB® library is one of the industry’s most diverse fully human antibody libraries available in the market today. And its proprietary C-lock™ and K-lock™ conjugation chemistries enable site-specific conjugation of toxins to the antibody, which will produce next generation homogenous ADCs with well-defined drug antibody ratios (DAR). Third, the collaborations will accelerate the development of Sorrento’s diverse portfolio of fully human monoclonal antibodies, ADCs, and bispecific antibodies. Management of Sorrento has been actively seeking strategic alliance in order to accelerate the development of its programs. The deal underscores Sorrento's commitment. Combination of Sorrento’s antibody technology with Nantworks’ proprietary genomic and molecular profiling technologies will bring drug candidates into clinic more quickly. Fourth, this is the first JV between Sorrento and Nantworks. This JV could go public soon. Based on the advancement of the first JV, the two companies could establish more joint ventures in the future in different therapeutic areas to develop first-in-class drug candidates. Collaboration with Conkwest Expands Sorrento’s Pipeline In Dec 2014, Sorrento and Conkwest entered into a definitive agreement to jointly develop next generation CAR-TNK™ immunotherapies for the treatment of cancer. Conkwest is a privately-held immuno-oncology company focused on developing proprietary Neukoplast®(NK-92™), a Natural Killer (NK) cell-line based therapy. The CAR-TNK technology platform combines Conkwest's proprietary Neukoplast cell line with Sorrento's proprietary G-MAB® fully human antibody technology and CAR designs to further enhance the potency and targeting of Neukoplast. Under the terms of the agreement, Sorrento and Conkwest will establish an exclusive global strategic collaboration focused on accelerating the development of CAR-TNKs for the treatment of cancers. Both companies will jointly own and share development costs and revenues from any developed CAR-TNK products. As part of the transaction, Sorrento will make a $9 million strategic equity investment in Conkwest and provide $2 million in research credit payments towards the development of novel CAR-TNK cell lines. Conkwest’s "off-the-shelf" CAR-TNK approach utilizes bioreactor-grown NK-92 cell line, Neukoplast, as the immune effector cells. These Neukoplast cells can be re-engineered in a virus-free process to express surface receptors using Sorrento's G-MAB library to yield a stable line of effector cells that recognize and target specific antigens on tumor cells. The CAR-TNK cells can also be generated and produced in large quantities, thereby obviating the need for expensive, decentralized 'biologistics'- a critical drawback of current CAR-T and dendritic cell therapies. Sorrento plans to rapidly move several of the CAR-TNK cell lines into the clinic to offer patients suffering from hematological malignancies and solid tumors an innovative immunotherapy to fight their cancers. We Maintain Our Buy Rating on Sorrento Shares We maintain our Buy rating on Sorrento share and reiterate our 12-month price target of $20.00 per share. Sorrento is a late stage development biopharmaceutical company with diversified pipeline. The company’s lead candidate Cynviloq has advanced to pivotal clinical trial and the company will use 505(b)(2) regulatory pathway to file for approval. This approach will shorten the development time of Cynviloq dramatically and reduce the development risks accordingly. We estimate Cynviloq will reach the market in 2016. Cynviloq targets the multibillion dollar cancer therapeutics market. The company’s second lead clinical program RTX targets the huge cancer pain market. Its unique mechanism of action and potency will help RTX command a niche of the cancer pain market if approved. RTX is currently in an investigator-sponsored Phase I/II clinical trial and Sorrento plans to initiate additional Phase I/II clinical trial for cancer pain in 2014. Recent formation of a subsidiary Ark Animal Therapeutics further expands the use of RTX in animal health. In addition to the two lead clinical programs Cynviloq and RTX, Sorrento also owns proprietary G-MAB® antibody library and ADC technology. Therapeutic antibodies and ADCs represent the biggest market in the current pharmaceutical industry with multibillion dollar sales. Sorrento’s G-MAB® is one of the most diverse fully human antibody library in the industry and its ADC technology holds key advantages over currently used competitor ADC technologies. The combination of these two platforms will not only expand its pipeline, but also provide partnership opportunities for the company to generate near term revenues. Sorrento has all the makings of a successful biotech company. In terms of valuation, we think Sorrento’s shares are undervalued at current market price. Current share price of $10.7 values the company at $389 million in market cap based on 36 million outstanding shares. This is a discount compared to its peers. Sorrento is a late stage development company with diversified pipeline. Its lead candidate Cynviloq, which targets the multibillion dollar cancer market, will be approved as early as in 2016 according to our estimate. The Company’s second lead product RTX, which targets the huge cancer pain market, will also reach the market in 2017. Sorrento’s G-MAB® and ADC platforms have great potential to target a variety of indications and provide partnership opportunities. According to our model, Sorrento will become profitable in 2018 with an EPS of $1.26 based on total revenue of $176.8 million. We think Sorrento should be valued at a P/E multiple of 30x which is the biotech industry average P/E ratio. Based on our 2018 EPS of $1.26, we arrive at a price of $20.00 per share using 25% discount rate for three years. Our target price values Sorrento at $720 million in market cap, which is still conservative in our view. Risks Related To Our Price Target Include: READ THE LATEST FULL RESEARCH REPORT HERE SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR and to view our disclaimer.

Development/Regulatory Risk: Although Sorrento’s lead program Cynviloq is in late stage development using the 505(b)(2) pathway, there are still some development and regulatory risks. The company’s RTX program is still in mid-stage development and development/regulatory risk is higher than Cynviloq. The G-MAB® and ADC programs are in preclinical development and will have a long way to go to reach the market. Both clinical and regulatory hurdles are significant at this point for these two programs.

Market Risk: Market fluctuation will also impact our price target though it’s independent from the company’s fundamentals.