Cancer Breakthrough Could Mean Big Gains for This Pharma Giant

The battle against cancer is both valiant and frustrating. Medical researchers are constantly developing new drugs and treatment methods to fight the dreaded disease, and while most improvements come gradually, the really big progressive leaps in treatment are few and far between.

Pharmaceutical giant Eli Lilly & Co. (LLY) announced today what it suspects could be one of those big leaps forward in the battle against one of the most prolific and pernicious varieties of the disease -- lung cancer.

In a press release, Lilly announced impressive clinical trial results for SQUIRE, the company's recently completed Phase III clinical study. The study found that "patients with stage IV metastatic squamous non-small cell lung cancer experienced increased overall survival when administered necitumumab in combination with gemcitabine and cisplatin as a first-line treatment, as compared to chemotherapy alone."

A positive result in a Phase III study, which is one of the critical hurdles before a drug is approved, is a big reason for optimism in patients afflicted with this variety of lung cancer. It's also a big positive for Lilly, as the mass adoption of an effective new therapy means millions in revenue for many years down the line.

Certainly, traders viewed the news as a big positive, as LLY shares spiked 4.4% in pre-market trade before giving back some of those initial gains.

This news comes at the right time for Lilly, as the company is facing the patent expiration of several of its most profitable drugs, including its best-selling drug, antidepressant Cymbalta. Patent expiration on Cymbalta happens later this year, and that will undoubtedly result in much less revenue from the product in 2014.

As for necitumumab, the therapy still faces regulatory challenges, although nothing more than the usual approval process. The company plans to submit necitumumab to regulators for approval before the end of 2014, and while that may seem like a long time from now, in drug approval terms it's just around the corner.

Interestingly, the thing that got Wall Street excited about the Lilly announcement on Tuesday was its unexpectedness. ISI Group analyst Mark Schoenebaum, who covers the stock, reflected on the analyst community's surprise over the news.

In an email note to clients, Schoenebaum wrote, "This is a clear upside surprise, as consensus (and my) expectations for this drug were basically zero." He added, "Recall that Bristol-Myers Squibb actually RETURNED this drug to LLY in a tacit declaration of no confidence a few years ago."

Necitumumab was originally developed by Bristol-Myers Squibb (BMY) and ImClone Systems, which Lilly acquired in 2008; however, analysts didn't see much promise for the drug. Thanks to the positive results in the Phase III study, all that has changed.

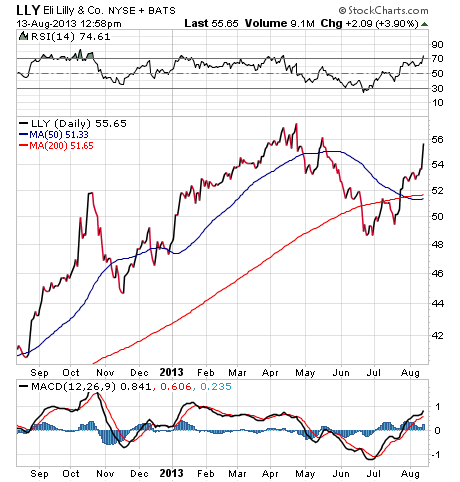

For traders, the move today in LLY shares could be just the beginning of a longer-term uptrend for the pharmaceutical giant. Shares have been on the rise since late June, and in July, the stock broke above both its short-term, 50-day moving average, as well as its long-term, 200-day moving average.

I suspect that the upside in LLY shares will continue in the back half of 2013, so traders should think about building positions here in anticipation of a 10%-15% move higher by year's end.

Recommended Trade Setup:

-- Buy LLY at the market price

-- Set stop-loss at $51.20, approximately 8% below the current price

-- Set initial price target at $64 for a potential 15% gain by year-end

Related Articles

2 Unusual Indicators Could Signal When the Market Will Turn